Dec 21, 2022

Energy stocks will be hot again in 2023. But now it's about dividends

, Bloomberg News

If you didn't have energy stocks on your books this year, you massively underperformed: Eric Nuttall

After two straight years of big gains, energy stocks could outperform the market again in 2023, but this time it will be higher dividends rather than oil that will spur appetite for the sector.

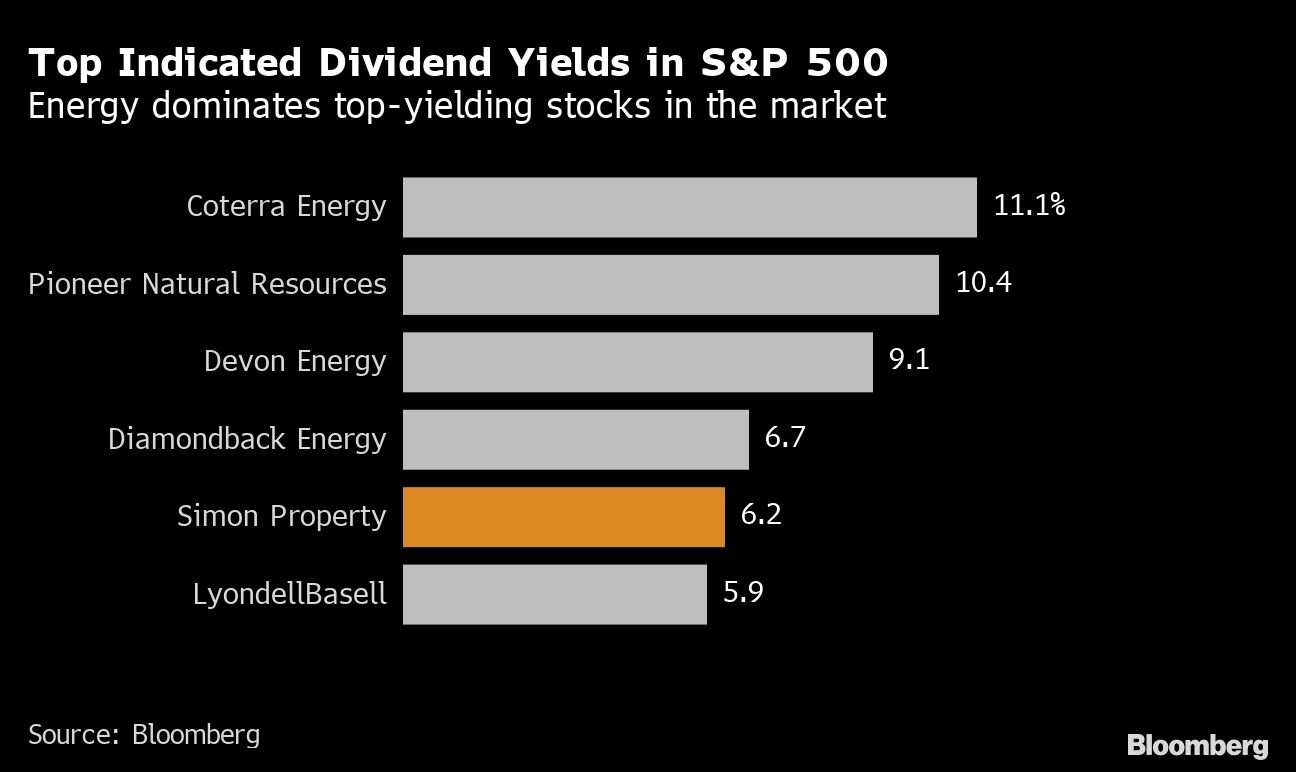

In an effort to lure income investors, energy firms have aggressively boosted dividends over the last 12 months. Diamondback Energy Inc. increased its payout 412 per cent in the span, the most of any S&P 500 member. Five of the index’s 10 biggest dividend boosts have come from the energy sector, including APA Corp.’s 355 per cent hike, Pioneer Natural Resources Co.’s 276 per cent raise and Halliburton Co.’s 167 per cent increase.

Those supersized payouts will look even more attractive if the U.S. economy slips into a recession next year, which would increase the allure of cash. Real U.S. gross domestic product is poised to shrink to meager 0.3 per cent growth in 2023, down from 1.9 per cent in 2022, according to data compiled by Bloomberg.

“In a recession, I want to see the cash,” Energy Income Partners Chief Executive Officer James Murchie said, adding that his investment firm was launched during the bursting of the dot-com bubble because investors were seeking “real income and real assets.” He expects the same dynamic to play out in a potential recession in 2023, driving equity positioning in dividend-paying stocks in energy and utilities.

“We want real assets rather than vaporware in our portfolio,” Murchie said.

Investors will look for total returns rather than just share price gains in 2023, Bank of America’s head of equity and quantitative strategy Savita Subramanian said in a Bloomberg TV interview this week. Subramanian was also bullish on the energy sector, which she said has demonstrated spending restraint despite higher oil prices.

The S&P 500 Energy Index’s total return so far in 2022 is approaching 63 per cent, which breaks down to 57 per cent price appreciation and another 6 per cent from yield. By contrast, the broader S&P 500 has posted a total negative return of 17 per cent — just a little better than its 19 per cent price decline thanks to payouts by index members.

The group of energy stocks in the U.S. equity benchmark climbed 2 per cent at 3:17 p.m. in New York Wednesday.

Investors tend to rush into dividend-paying stocks in a recession in search of cash while the economy crashes around them and dollars are harder to earn. But investors should look deeper and screen companies for free cash flow, rather than dividends, if they’re looking for reliable income streams through a recession, SPEAR Invest’s Ivana Delevska said.

“That’s the key more broadly for the market — cash flow generation,” the firm’s chief investment officer noted said, adding that her fund likes commodities and industrial stocks heading into 2023 because of their free cash profile and because they’re cheap. “The reason we like commodities and industrials in a recession is because a recession is already priced into them.”

Still, investors that go looking for free cash flow generation typically find big dividend payers. “Most of the companies that have the highest cash flow yield, have the highest dividends,” Siebert Williams Shank analyst Gabriele Sorbara said.