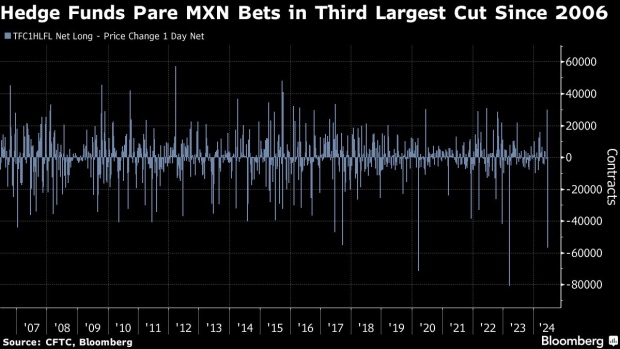

Jun 24, 2024

Hedge Funds Cut Mexican Peso Bets in One of the Biggest Retreats on Record

, Bloomberg News

(Bloomberg) -- Hedge funds slashed their bets on the Mexican peso in the aftermath of an election surprise that roiled markets and cast doubt on the outlook for what had been one of the world’s top currency trades.

Leveraged funds cut their net long position by 56,709 contracts to 27,304 contracts, the third-biggest reduction since the Commodity Futures Trading Commission began compiling records in 2006. Asset managers reduced their bullish wagers to 76,520 contracts, the lowest in about two years. The data, which captures the week through June 18, were released Monday.

The peso is down more than 6% against the US dollar since the June 2 vote, trailing all developing-nation peers over the period, though it has trimmed some of those losses recently.

Traders fled the profitable carry trade — borrowing in lower-yielding currencies to buy the peso — amid mounting fears over the policies President-elect Claudia Sheinbaum’s government will pursue, including measures to overhaul the way federal judges are chosen.

“This is a massive clean up” of long positions, said Benito Berber, chief Latin America economist at Natixis. “The potential negative impact of a judicial reform on the investment climate and the passage of additional anti-market reforms by a Morena-dominated Congress” are some of the risks, he said.

--With assistance from Carter Johnson.

©2024 Bloomberg L.P.