Jun 19, 2024

UK House Prices Edge Higher in Sign of Stability After Downturn

, Bloomberg News

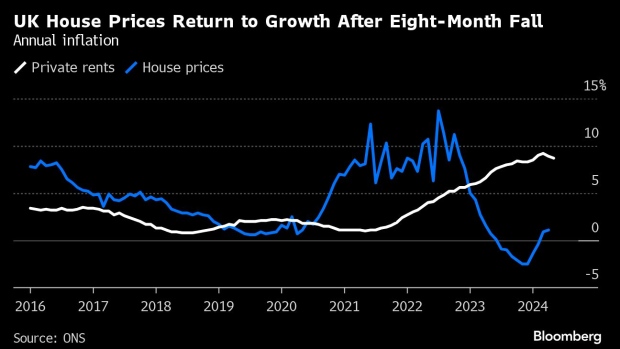

(Bloomberg) -- UK home prices rose for a second straight month in April, according to official data suggesting the housing market is stabilizing after a dip last year.

The average price of a home rose to £281,000 ($357,760), a 1.1% rise compared to a year ago, the Office for National Statistics said Wednesday, citing Land Registry records. This followed a 0.9% gain in March, which was revised down from 1.9%.

Those figures capped eight months of declines in the official measure of house prices and add to evidence that the market avoided a collapse that many analysts predicted after the Bank of England pushed interest rates to a 16-year high. Mortgage lenders, using more timely data from loans they make, say prices have roughly stagnated in the past few months.

Property experts hope a rebound will materialize in the second half of the year when the Bank of England could ease borrowing costs as inflation returned to target.

The ONS’s House Price Index, which measures prices when property transactions are completed, is the most reliable indicator of the market because it includes cash buyers who don’t need a loan. It’s also the most lagging indicator.

Nationwide Building Society recorded mild growth in May, while Halifax data pointed towards stagnation with a 0.1% decline in property values that month.

“Since the start of the year, we have seen healthy progress within the housing sector, with consumers finding a sensible balance of affordability and market confidence,” said Nathan Emerson, CEO of Propertymark. “We should see a stable market for the foreseeable future.”

The ONS said the North West and the East Midlands were the regions seeing the highest increase in house prices. At the same time, London house prices fell 3.9% to £281,373 ($358,460) in the year to April.

Easing mortgage rates are luring more buyers back to the market. According to Rightmove, the average five-year fixed mortgage rate is now 5.03%, down from 5.39% a year ago. The average two-year mortgage rate has also fallen 5.44% from almost 6% last year.

That helps take some of the pressure of the lettings market where supply shortages have sent rents soaring. The ONS said rents rose 8.7% in the year to May, easing from 8.9% the month before. London private rental inflation fell to 10.1%, but remains around a record annual rise of 11.2% recorder in 2024.

“While the rental market has already suffered, the reduction in mortgage rates may help slow the rise in rents,” said Harps Garcha, director at Brooklyns Financial. “However, a longer-term strategy is essential to encourage private landlords back into the market and ensure a balanced and stable housing sector.”

©2024 Bloomberg L.P.