Jun 26, 2024

Turkish Rate Cut Likely Months Away for Economy Going in Reverse

, Bloomberg News

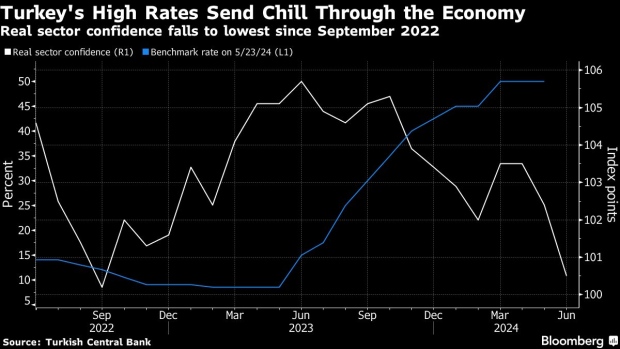

(Bloomberg) -- Turkey’s central bank is set to stick with an interest-rate pause that’s likely to last through much of the year or even beyond, engineering a slowdown in the economy to lower one of the world’s highest levels of inflation.

Economists surveyed by Bloomberg are unanimous in forecasting the one-week repo rate will be kept at 50% on Thursday for a third straight month. Wall Street lenders like Bank of America Corp. anticipate the first cut closer to the end of this year, while Morgan Stanley pushed back its expectations of easing to the first quarter of 2025.

“The economy is slowing down,” BofA analysts including Zumrut Imamoglu said in a note. “The continuation of tight monetary policy is critical to ensure disinflation continues into 2025 and beyond.”

Rate hikes that began a year ago have taken until now to become a drag on the economy, in part because more restrictive financial conditions were out of sync with the generous fiscal measures such as wage hikes enacted by the government. But momentum is reversing as fiscal policy tightens, with inflation on track to start decelerating from this month after peaking above 75%.

A measure of Turkish manufacturing activity has been below the 50-mark that separates expansion from contraction for two months, and factories are using less of their potential than at any point since last August. Pessimism across businesses is also on the rise, according to a survey by the central bank.

“Growth is expected to lose significant momentum with tightening financial conditions, slowing real wage growth and leading to a likely increase in the unemployment rate,” said Muhammet Mercan, ING Bank’s chief economist for Turkey.

Investors are scrutinizing the trajectory of prices after piling into local assets this year in anticipation that Turkey’s embrace of more conventional policies will make it less prone to inflation crises.

Officials are targeting inflation at 38% at the end of the year, maintaining a hawkish bias and warning they could stiffen policy if the outlook for price growth deteriorates. The central bank’s preferred gauge is monthly inflation, which has been well above its long-run average by staying at over 3% throughout this year.

“Solid demand conditions prevent a faster adjustment in the inflation trend and trade balance,” said Garanti BBVA Research economists including Gul Yucel.

The Turkish bank expects more fiscal adjustments in the second half of the year to support the rebalancing of the economy away from consumer spending. Authorities have already drafted new tax proposals, as part of what would be the biggest revamp in a generation.

What Bloomberg Economics Says...

“Credit and deposit rates offered by lenders have eased since the central bank’s last policy gathering in May — a risk we highlighted given the liquidity steps following that meeting. Hence, it will likely supplement the rate pause with further tightening in its policies governing credit growth rates, reserve requirements and banking regulation.”

— Selva Bahar Baziki, economist. Click here to read more.

A key risk to the central bank’s outlook is how the government handles the blowback from tighter policies on companies and households. The main opposition party has been calling for a mid-year increase to the minimum wage next month, an adjustment made by the government in recent years to compensate for inflation.

Labor Minister Vedat Isikhan said Wednesday that Turkey has definitively ruled out such a hike. That would avoid fueling domestic demand and inflationary pressures, as was the case after a 49% raise at the start of this year.

But firms like Uysal Sekerleme, a major confectionery company in the central city of Konya, are increasingly feeling the sting, especially as demand suffers both at home and abroad.

Facing high borrowing costs and costlier raw ingredients, business has been stagnant for the past four to five months, leaving it “frightened” about the future, said Ahmet Yalcintas, a manager at Uysal Sekerleme.

“The whole burden is on small and medium-sized enterprises,” Yalcintas said by phone. “Most of the companies that took out loans are unable to pay them back.”

--With assistance from Joel Rinneby.

(Updates with analyst comment in sixth paragraph.)

©2024 Bloomberg L.P.