Jul 2, 2024

South Korean Crypto Exchanges Seek to Dispel Fears of Delistings

, Bloomberg News

(Bloomberg) -- South Korea’s leading crypto exchanges sought to push back on the idea that new rules to protect investors may quickly choke some of the nation’s hallmark speculative trading in smaller digital assets.

The platforms will review their listings of such so-called altcoins to ensure compliance with the user protection legislation that comes into effect on July 19, according to the Digital Asset Exchange Alliance, an industry trade body.

The evaluation will span 1,333 coins over the next six months and hence immediate “mass delistings are unlikely,” the alliance said in a statement on Tuesday. Going forward, all new token listings will be assessed in the context of the Virtual Asset User Protection law once it is in force, the group added.

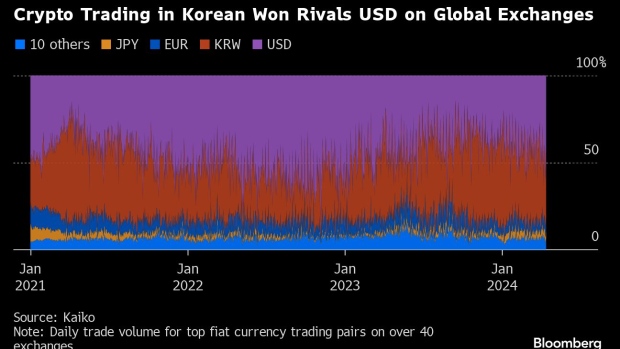

South Koreans are such a mainstay of the crypto market that at one point this year the won supplanted the dollar as the most-used currency for swapping in and out of digital assets. About 10% of the population has exposure to tokens, and smaller coins — not market-leader Bitcoin — comprise the bulk of trading.

Crypto prices sank two weeks ago in part as investors evaluated a report suggesting South Korean exchanges would have to cut back on available tokens under the new rules, highlighting the sensitivity of the topic for speculators.

South Korea infamously spawned Do Kwon and his doomed Luna and TerraUSD tokens, which blew up more than $40 billion when they imploded in 2022. The scandal helped to prompt the new legislation amid enduring enthusiasm for risky and volatile crypto investments in Asia’s fourth-largest economy.

Crypto trading in South Korea is dominated by Upbit, which at times has ranked in the top five exchanges globally. Upbit and its rivals face the threat of higher costs as they implement the requirements of the digital-asset code.

--With assistance from Jaehyun Eom.

©2024 Bloomberg L.P.