Jun 18, 2024

Demand Rises at South Africa Bond Auction on Investor Optimism

, Bloomberg News

(Bloomberg) -- Investor demand at South Africa’s weekly government bond sale rose, signaling improved sentiment after political parties in the country agreed to form a governing alliance and re-elected Cyril Ramaphosa as president.

Primary dealers placed orders for 19.16 billion rand ($1.1 billion) of debt, more than five times the 3.75 billion rand of securities on sale Tuesday. This compares with a ratio of 3.9 at the previous auction, according to central bank data compiled by Bloomberg.

The African National Congress has agreed to form a government of national unity with parties including the centrist Democratic Alliance after losing its parliamentary majority in last month’s election. Ramaphosa is due to be sworn in Wednesday, with investor focus turning to who he will appoint to his cabinet.

“Politically, we see the positive progress on forming a coalition agreement as a favorable market outcome, making local bonds more attractive,” said Hannah de Nobrega, an analyst at Prescient Investment Management.

The reduction of political risk in South Africa, coupled with prospects of interest-rate cuts in the US as inflation moderates there, should support demand for the debt, she said.

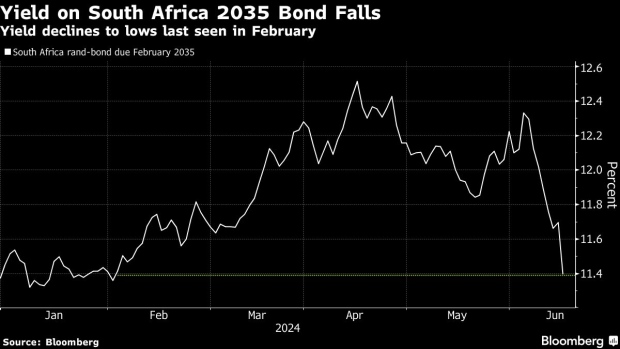

Yields on South Africa’s rand notes maturing in 2035 fell 31 basis points by 3:40 p.m. in Johannesburg to 11.41%. That’s the most in a day since March 2022, taking total declines in June to 84 basis points.

South Africa’s local-currency bonds have been the best performing in emerging markets this month, handing investors a return of 6.4% in dollar terms. That compares with the 0.02% average loss for peers in a Bloomberg EM Local Government Bond Index.

©2024 Bloomberg L.P.