Jun 20, 2024

China’s Property Sales Outlook Worse Than Ratings Firms Expected

, Bloomberg News

(Bloomberg) -- Two global credit ratings firms lowered their forecasts for China’s property market, as an accelerating slump in home prices hampers the country’s efforts to rescue the sector.

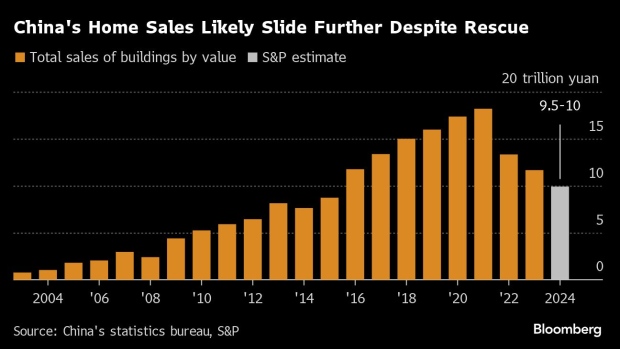

S&P Global Ratings now expects residential sales to drop 15% this year, more than the 5% decline it projected earlier. That will put sales below 10 trillion yuan ($1.4 trillion), around half the peak in 2021, the ratings company said Thursday.

Fitch Ratings on Wednesday cut its annual sales estimate to a decrease of 15%-20%, worse than an earlier estimate of a 5%-10% drop.

The ratings firms’ bleaker outlook suggests they have little confidence that recent stimulus measures will end the property slump that’s dragging on the world’s second-largest economy.

The institutions blame a bigger-than-expected drop in home prices, which deters buyers. Values of new homes fell the most in almost a decade in May, official figures showed this week, while used-home prices had the sharpest decline in at least 13 years.

Real estate accounts for about 78% of household wealth in China — double the US rate — and families typically save for years and borrow from friends and relatives to purchase a home.

Policy makers unveiled a broad real estate rescue package last month, involving relaxing mortgage rules and encouraging local governments to buy unsold homes. Three of the nation’s biggest cities — Shanghai, Shenzhen and Guangzhou — have since rolled out major easing for homebuyers, slashing downpayment requirements and allowing room for cheaper mortgages.

©2024 Bloomberg L.P.