Jun 24, 2024

China Imposes More Fertilizer Export Controls to Protect Farmers

, Bloomberg News

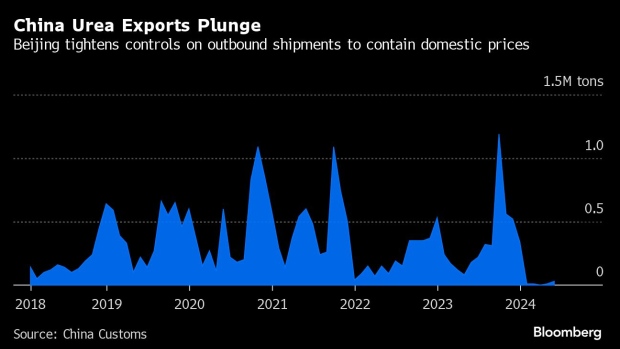

(Bloomberg) -- China is further restricting fertilizer exports, as it seeks to contain domestic prices, cut farming costs and bolster grain security.

The curbs imposed earlier this month apply to urea, a nitrogen-based fertilizer, and phosphates, according to people familiar with the matter, who didn’t want to be named discussing a sensitive issue. In years past, China has been a key supplier of the two types, and the new restrictions risk pushing up prices of essential crop nutrients around the world.

Exports of urea and phosphates had already slowed this year, to a trickle in the case of the former, after limits put in place at the end of 2023. Now, urea shipments have been halted entirely, the people said. For phosphates, customs is stepping up inspections on outbound cargoes, which could reduce sales even more, they said.

A fax sent to China’s customs administration seeking comment didn’t get an immediate response.

China’s policymakers are contending with a number of worrying signals from the agricultural sector. Farmers are struggling with depressed grain prices and elevated costs, which has led to measures to protect the domestic market. At the same time, extreme weather events pose a rising threat to crop production in the country’s main growing regions. Local urea futures, which dropped to a nine-month low at the start of April, have staged a rebound.

Total fertilizer exports from China actually climbed to a six-month high of nearly 2.5 million tons in May, as sales of ammonium sulfate, another nitrogen-based nutrient, offset the drop in the other products. China typically imports the third main fertilizer type, potassium-based potash.

As recently as 2020, China was the world’s second-biggest fertilizer exporter after Russia. But rising prices, particularly after Moscow’s invasion of Ukraine, forced Beijing to limit sales, which it has periodically relaxed and tightened according to circumstances. In 2023, it was still the world’s top supplier of both urea and the world’s most widely used phosphate.

On the Wire

Iron ore fell to the lowest level since early April on concerns that China will struggle to resolve its property crisis and as global supplies remain plentiful.

Lithium industry watchers hoping the battery metal was poised to rebound from an epic slump have been hit by the realization prices have fallen again this month, with inventories piling up as electric vehicle demand signals stay gloomy.

As copper surged to record highs last month, several senior Chinese traders started trying to contact western hedge fund managers whose names they’d only read in the press.

China and the European Union agreed to start talks on the bloc’s plans to impose tariffs on electric vehicles imported from the Asian nation.

This Week’s Diary

(All times Beijing unless noted.)

Monday, June 24:

- Nothing major scheduled

Tuesday, June 25:

- “Summer Davos” in Tianjin, day 1

Wednesday, June 26:

- CCTD’s weekly online briefing on Chinese coal, 15:00

- “Summer Davos” in Tianjin, day 2

Thursday, June 27:

- China industrial profits for May, 09:30

- LME Asia Metals Seminar in HK, 09:00

- “Summer Davos” in Tianjin, day 3

Friday, June 28:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, June 29

- Nothing major scheduled

Sunday, June 30

- China’s official PMIs for June, 09:30

--With assistance from Winnie Zhu.

©2024 Bloomberg L.P.