Jun 18, 2024

Chile Central Bank Pares Pace of Rate Cuts and Lowers Borrowing Costs to 5.75%

, Bloomberg News

(Bloomberg) -- Chile’s central bank cut its interest rate by a quarter-point on Tuesday, slowing the pace of reductions and signaling odds of an eventual pause to monetary easing with electricity prices set to pressure inflation.

Policymakers voted four-to-one to lower borrowing costs to 5.75% as expected by most analysts in a Bloomberg survey. The central bank’s Vice President Stephany Griffith-Jones backed a half-point reduction.

In an statement, board members wrote that borrowing costs will continue to fall during the policy horizon at a pace that considers the evolution of the macroeconomic outlook and its effects on the inflation trajectory.

“The board estimates that, if the assumptions of the central scenario materialize, the monetary policy rate would have accumulated the bulk of the cuts planned for this year during the first half,” they wrote.

Central bankers led by Rosanna Costa are toning down rate cuts in a cycle that has reduced borrowing costs by 5.5 percentage points in the past year. Analysts see inflation back at the 3% target in 2025, but there are indications it won’t be plain sailing. The domestic economy is firming, local electricity tariffs will rise and the Federal Reserve has given no indication when it will start to ease.

“The central bank is signaling there is still a little left in their easing and, in the future, they are going to continue slowly,” said Sebastian Diaz, an economist at Pacifico Research in Santiago. “It is more probable that we’ll have pauses.”

Policymakers raised their 2024 year-end inflation forecast to 4.2% from 3.8% and also boosted their 2025 estimate to 3.6% from 3%, according to their quarterly monetary policy report published early on Wednesday. Central bankers see cost-of-living increases at 3% in 2026.

Biggest Changes

Tuesday’s quarter-point cut followed reductions of 50, 75 and 100 basis points, respectively, in the previous three meetings.

Since March, “the biggest changes in the scenario are a better starting point for domestic demand, which will be supported by higher copper prices, and the readjustment in electricity tariffs, which will have a significant impact on inflation, especially in 2025,” policymakers wrote in the statement.

Domestic electricity costs will rise due to a new law unfreezing tariffs that have been held down since 2019. That measure could add as much as 50 to 70 basis points to this year’s inflation rate, Banco Itau analysts including chief Latin America economist Andres Perez wrote in a June 14 note.

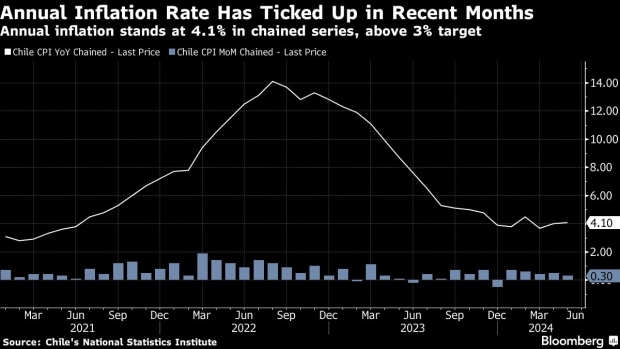

Consumer prices have already risen more than economists expected in four out of the first five months of the year. Annual inflation accelerated to 4.1% in May, according to the national statistics agency’s chained series.

Global inflation has continued to ease, though at a more moderate pace, board members wrote on Tuesday.

“It would appear that we won’t have any new rate reductions until October or December,” Jorge Selaive, chief economist at Scotiabank Chile, wrote on X. “It’s very conditional on inflation.”

Still, central bankers have gotten some help in their inflation fight from the peso, which has gained over 3% against the dollar in the past two months, paring its year-to-date loss. The currency has been bolstered by higher prices of copper, which is Chile’s top export.

Meanwhile, local economic activity has returned to a path of growth, policymakers wrote in their statement. While domestic demand expanded more than expected in the first quarter, some factors that drove activity at the start of the year were temporary, central bankers wrote.

There are reasons to remain cautious, “particularly when it comes to temporary shocks that are impacting the inflation outlook,” Credicorp Capital economists Daniel Velandia and Samuel Carrasco wrote in a note. “We estimate that the next BCCh moves are cuts of 25bp per meeting, including pauses in some of them, and a year-end policy rate of 5.25% with an upward bias.”

--With assistance from Giovanna Serafim.

(Updates to add new inflation forecasts in seventh paragraph)

©2024 Bloomberg L.P.