Jun 27, 2024

Asian Firms Sell Record $590 Billion of Local Bonds in Quarter

, Bloomberg News

(Bloomberg) -- Asian credit markets are suddenly standing out, even in a world awash in debt deals.

Total corporate bond issuance in the region across all currencies has surged to $1.3 trillion this year, creating a number of superlatives: Sales of local-currency debt by companies has hit a record for the first half, while this week alone saw the biggest weekly dollar bond issuance for 17 months, taking into account both corporates and governments.

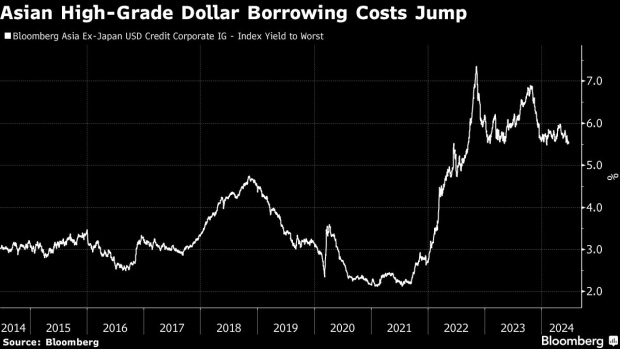

The surge in debt sales has come as the region’s borrowers face nearly $2 trillion of maturing bonds next year and the similar amount in 2026. There’s also the incentive to lock in historically tight spreads for dollar notes before they potentially widen, and to tap into the current investor appetite for higher yields.

Total company bond issuance in the first half has climbed 18% to an all-time high, according to data compiled by Bloomberg. Sales of dollar-denominated debt, by corporates and governments, jumped to $22 billion this week, the most since the start of 2023, as spreads for regional issuers have remained tighter than for their US peers.

The issuance bonanza is being fueled in large part by Chinese companies taking advantage of unprecedentedly low onshore borrowing costs. Japanese and Australian firms are also selling a record amount of local-currency debt, the data show.

Resilient economic growth through most of the world, and robust demand for yield have helped propel the surge in issuance around the globe this year. Companies around the world have sold $3.58 trillion of debt so far in 2024, close to the record of $3.6 trillion set in the first half of 2020.

The surge in Asia-Pacific local bond issue is expected to continue “as many domestic markets can now provide financing terms like size and tenor that are increasingly competitive with the dollar market,” said Carla Goudge, managing director and head of debt syndicate, Asia Pacific at HSBC Holdings Plc. “Asia’s wealth boom has created a strong investor base for many asset classes including credit, thus providing ample liquidity in financial markets across the region.”

The increase in local-currency issuance this year is part of a larger story about the deepening of Asian debt markets, with onshore bond sales in both China and India doubling in the last decade as their economies expanded. Also fueling that growth has been the Federal Reserve’s aggressive series of interest-rate hikes starting in March 2022.

Local-currency corporate bond sales in Asia Pacific have already surpassed $1.1 trillion this year, with Chinese firms accounting for about three quarters of that, the data compiled by Bloomberg show. Other parts of the world are also seeing a surge in local-currency borrowing. South American companies have sold almost $36 billion of such debt this year, double the amount of the same period in 2023, the data show.

Another driver of local-currency issuance is the strengthening dollar. Many firms are seeking to avoid borrowing in the greenback to avoid having higher repayments in the own currency if the greenback keeps appreciating.

In China — Asia’s largest debt market — the calculation is even simpler as the central bank has cut its policy rates below those of the Fed. The average yield on five-year AAA corporate yuan bonds is about 2.3%, about half what US peers have to pay in their market.

In Japan, local companies still pay an average of less than 1% to sell yen bonds even after the central bank scrapped its negative-interest rate policy in March. Firms have priced a record of more than 7.7 trillion yen ($47.9 billion) of notes so far in 2024.

Likewise, Australian firms have sold unprecedented amounts of local bonds over the first and second quarters, totaling about A$56 billion ($37.1 billion) this year, data compiled by Bloomberg show.

One advantage of the increase in local-currency debt sales for investors is that it’s helped mitigate some of the pressures on issuers, according to Omar Slim, co-head of Asia fixed income at PineBridge Investments in Singapore.

--With assistance from Sharon Klyne, Divya Patil and Yuling Yang.

©2024 Bloomberg L.P.