Aug 10, 2021

Swiss Franc Shakes Off Intervention Threat With Its Broad Appeal

, Bloomberg News

(Bloomberg) -- The Swiss National Bank may say it, and valuation metrics may show it, but traders are unconvinced the franc has gotten too strong.

The haven currency’s surge to a nine-month high against the euro has brought its valuation back into focus among investors. Yet the central bank’s own data on real effective exchange rates show that the franc has shed most of its premium seen at the height of the pandemic.

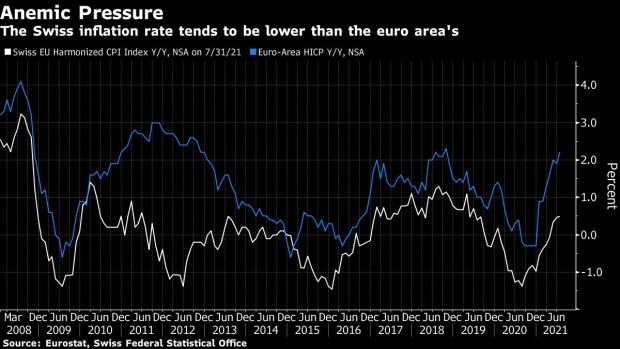

Its potential for even more gains remains undiminished as traders say Switzerland’s persistently low inflation makes the franc a reliable store of value. And with the euro area’s monetary policy poised to remain expansionary -- and likely to weigh on the euro -- the Swiss currency’s rally is under no immediate threat.

“Is it really too strong? It’s an open question,” said Nadia Gharbi, an economist at Banque Pictet & Cie SA. “It’s a means of communications for them to justify the accommodative monetary policy,” she said, referring to the central bank’s war on a stronger franc with ultra-low interest rates and repeated interventions.

The central bank assessed the franc to be “highly valued” in June, and the currency has only strengthened 1.5% since then. It is also the most overvalued currency in the Group of 10, according to OECD’s model based on purchasing-power parity. The franc touched 1.07203 per euro on Friday, the strongest level since November 9.

Still, investors have ignored those signals and piled in to the franc alongside the Japanese yen in recent weeks, seeking a refuge from fears the spread of the delta coronavirus variant could derail global growth. The plunge in bond yields from Treasuries to bunds has also boosted the currencies’ appeal.

Risk of Intervention

All this raises the inevitable specter of central-bank intervention. Bouts of global risk aversion typically drive investors into the franc, and the SNB has battled a too-strong currency for more than a decade.

Its monetary policy -- consisting of negative interest rates plus a pledge to wage currency market interventions if needed -- is designed to stem the franc’s appreciation. It also includes occasional jawboning -- like the June statement on its willingness to step in should the currency rise too much.

“You could also argue that it would be even stronger if not for such aggressive SNB intervention in the past,” said MUFG strategist Lee Hardman, citing Switzerland’s sub-1% inflation as well as its current-account surplus.

When asked about the franc’s valuation, a spokesman for the SNB said the June assessment of a ‘highly valued’ currency remained in force.

The European Central Bank’s latest strategy review, meanwhile, supports the view that policy in the euro area will remain expansionary for a long time after the pandemic, according to Commerzbank strategist Thu Lan Nguyen. Upside potential for the euro against the franc could therefore be limited even once Covid cases start subsiding, she said.

The question now is at what level the Swiss National Bank might intervene. Last year’s low around 1.05 per euro could be a line in the sand, according to analysts from ING and Monex Europe, though there are arguments it could be both higher and lower. It could be closer to 1.03 if the SNB used a real trade-weighted measure as a guide, according to ING analysts Chris Turner and Francesco Pesole.

“In real terms, Switzerland’s persistently low inflation renders the currency cheaper compared to 2020’s average, suggesting there is some room for the currency to strengthen in nominal terms without triggering meaningful SNB intervention in FX markets,” said Simon Harvey, senior FX market analyst at Monex Europe.

Still, “the speed of the franc’s rally is concerning on an inflationary standpoint, which may invite intervention by the SNB.”

©2021 Bloomberg L.P.