Apr 26, 2024

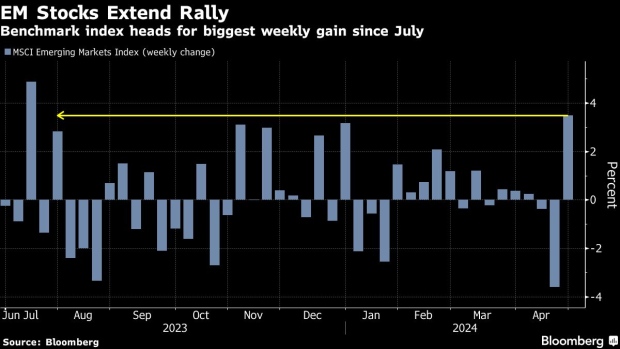

EM Stocks Head for Best Week Since July on US Tech Spillover

, Bloomberg News

(Bloomberg) -- Emerging-market stocks rose Friday, cementing their biggest weekly advance in nine months, as Asian technology stocks got a boost from US corporate earnings that confirmed booming demand for artificial intelligence.

The MSCI Emerging Markets Index finished the session 1.3% higher, with Taiwan Semiconductor Manufacturing Co., Tencent Holdings and Alibaba Group Holding accounting for the biggest chunk of its gains. The gauge rose 3.7% for the week, trimming monthly losses sparked by reduced expectations for Federal Reserve rate cuts.

While risks from slowing Chinese growth to higher-for-longer rates in the US continue to weigh on emerging markets, the equity outlook has improved on account of a spillover effect from US corporate earnings, led by the technology sector. That helped Asia outperform the other two EM regions — Latin America as well as Europe, Middle East and Africa — this week. Stocks also overshadowed bonds and currencies that were taking their cues from Fed rates pricing.

On Friday, a gauge of developing-nation currencies also edged higher after the US PCE deflator, the Federal Reserve’s favorite gauge of inflation, failed to confirm the market’s worst fears.

Strong US earnings reports are emboldening analysts to raise their forecasts for profits at emerging-market companies. The average forecast for 12-month earnings among the MSCI gauge’s members has increased to the highest level since September 2022. That increase is also led by Asian tech names.

“We continue to like the EM tech space,” said Alejo Czerwonko, UBS Global Wealth Management’s chief investment officer for Emerging Markets Americas.

“The 1Q24 earnings season has so far beat expectations, especially on the strong revenue and profitability guidance around artificial intelligence,” Czerwonko wrote, citing opportunities in markets such as Taiwan and Korea.

South African assets rallied after an opinion poll showed higher odds of a market-friendly coalition emerging from national elections. Dollar notes jumped across the curve, while the rand also strengthened.

At the end of the day, Bolivia’s credit rating was cut further into junk by Moody’s Ratings. The credit assessor said falling foreign-exchange reserves threaten a balance-of-payments crisis for the South American nation.

--With assistance from Philip Sanders.

©2024 Bloomberg L.P.