Mar 25, 2024

Crypto Funds Mark Biggest Week of Outflows on Record, CoinShares Says

, Bloomberg News

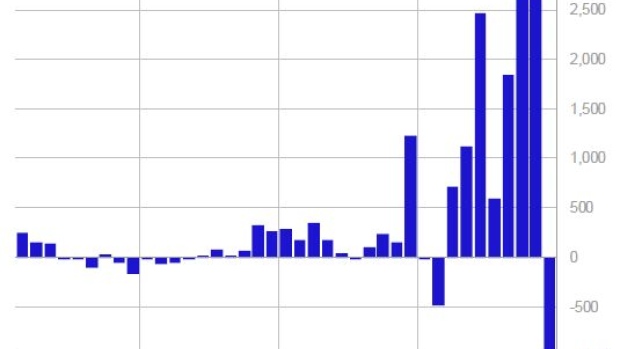

(Bloomberg) -- Global crypto funds took a sharp downturn last week as investors pulled out $942 million — the most on record, according to CoinShares International Ltd.

A seven-week streak of inflows saw more than $12 billion move into the funds, helping drive Bitcoin to an all-time high of $73,798 on March 14. Yet, the slide in the largest cryptocurrency since then through Friday made investors leery, leading to a reversal in net flows last week, according to James Butterfill, head of research at CoinShares.

“The recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the US,” Butterfill said in a report Monday.

Those new exchange-traded funds drew some $1.1 billion in inflows last week, which he said helped in “partially offsetting incumbent Grayscale’s significant $2 billion outflows last week.”

Highly anticipated US spot Bitcoin ETFs, which started trading earlier this year after receiving approval from the US Securities & Exchange Commission, have made up the majority of total crypto fund flows, with some investors who owned older Canadian and European funds moving their money to cheaper US funds. Last week, the 10 US Bitcoin funds saw $888 million in outflows — about 94% of total global crypto fund flows, according to data compiled by Bloomberg.

Funds holding Ether, Solana and Cardano also saw combined net outflows of about $43 million last week, according to CoinShares. Altcoins saw relatively positive performance, with tokens including Polkadot, Avalanche and Litecoin seeing inflows of $16 million in the same time period, Butterfill said.

Bitcoin rose for a third day Monday, climbing 6.8% to $70,622 as of 1:09 p.m. in New York.

(Corrects Bitcoin’s record high in second paragraph of story that ran on March 25.)

©2024 Bloomberg L.P.