Aug 31, 2022

Chinese Junk Bonds Just Chalked Up Their Best Month in a Decade

, Bloomberg News

(Bloomberg) -- China’s embattled high-yield dollar bonds rallied in August to deliver their best returns in 10 years, after greater government support for the crisis-hit property sector sparked bets that the worst of a more than year-long rout could be over.

The notes, dominated by real estate firms, returned 6.8% in August, according to a Bloomberg index. That’s the best month since February 2012, and ends a record 11 straight months of losses. It’s also lifted average prices off all-time lows, though they’re still in distressed territory at 64 cents on the dollar.

Money managers including BlackRock Inc. and Fidelity International Ltd. slowed selling of China property bonds in August to just $145 million of par value from more than $5 billion a month earlier, according to Bloomberg Intelligence analysts. Prudential Plc was among those adding to its exposure in recent weeks. Junk dollar notes were little changed Thursday morning, according to credit traders.

A flurry of steps to help the property sector and economy have fueled the rally in China’s junk dollar bonds.

First came an unexpected policy rate cut by the People’s Bank of China on Aug. 15, the first since January. Around that time, news emerged that authorities planned to help a group of six developers sell bonds onshore with full state guarantees and use proceeds for overseas debt payments. Offshore notes from some of those developers, including CIFI Holdings Group Co. and Country Garden, have soared more than 20 cents from record lows.

More signs of support came on Aug. 19, when the official Xinhua News Agency reported that the government would offer special loans through policy banks to ensure property projects are delivered to buyers. Days later, banks reduced loan prime rates, and started lowering mortgage rates too. On Aug. 24, China’s cabinet outlined a further 1 trillion yuan ($145 billion) of measures to bolster economic growth.

These are “major developments,” according to Owen Gallimore, head of APAC credit analysis at Deutsche Bank AG. “The bottom of the market has likely been seen now,” and one focus ahead will be whether the state guarantees are extended beyond the initial group of builders, he said.

China’s property market, which accounts for about a quarter of the world’s second biggest economy, has been rocked by a government crackdown that began in 2020 on developers’ excessive borrowing and real estate speculation. The turmoil snowballed in recent months into unprecedented loan boycotts from angry homebuyers and suppliers. Liquidity crunches have prompted builders to stall many projects across the country and leave fees unpaid, as defaults piled up to the worst levels ever.

Policy makers have been fine tuning their approach for some time now, trying to prevent wider contagion from the clampdown even as they stick to a goal of ensuring homes are for living, not speculation.

But until recently, the steps were generally met with skepticism in the credit market, where previous rallies soon succumbed to more news about defaults and debt extensions.

That was the case in November last year, when the central bank signaled an easing bias while the State Council urged local governments to speed up spending. And again in March, after authorities once again promised to prioritize stable economic growth.

“Similar rallies were seen last November and in March, but they quickly faded due to the market’s disappointment toward the degree of policy help,” according to Li Kai, chief investment officer of Beijing Shengao Fund Management Co.

But this time is likely different, given more efforts from higher-level government departments, and that the companies that haven’t defaulted yet have much better fundamentals, he said.

China’s sovereign bonds also gained in August, putting them among the top in global performance rankings as the nation’s rate cuts reinforced its monetary policy divergence with most of the world.

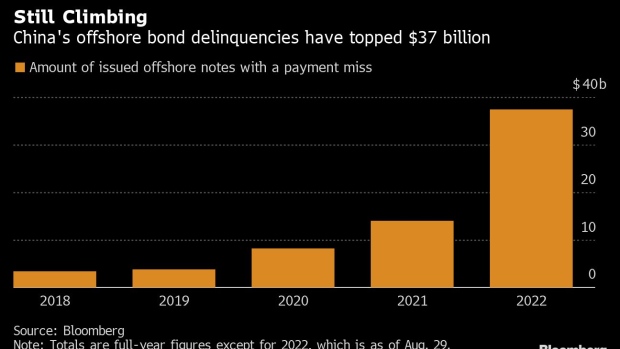

Still, risks abound. Even after the recent rebound, Chinese high-yield dollar bonds have lost 29% in 2022. And offshore defaults have surged to a record of more than $37 billion this year.

Authorities are set to step up scrutiny of companies seeking to sell offshore debt. Borrowers may be required to receive approval for issuance of offshore debt with tenors longer than one year from the National Development and Reform Commission, according to a recent draft for comments.

As investors consider wading back into the market even more, one of the most important potential bullish signals would be any sustained rebound in the housing market. New-home sales for the 100 biggest developers dropped 32.9% from a year earlier in August, although that monthly decline was the lowest this year.

There were also glimmers of hope in the latest round of earnings, even as the reports underscored challenges for more uniform improvement amid continued Covid restrictions.

Country Garden, the largest builder by sales, posted a record 96% drop in first-half profit on Tuesday while its biggest rival China Vanke Co. reported an 11% increase in net income.

Are you bearish or bullish on China? China is the theme of this week’s MLIV Pulse survey, which takes one minute. Click here to participate anonymously.

(Adds prices and fund-manager activity in the third paragraph.)

©2022 Bloomberg L.P.