Jul 3, 2024

AI Startups Inject Some Life Into VC Dealmaking in the US

, Bloomberg News

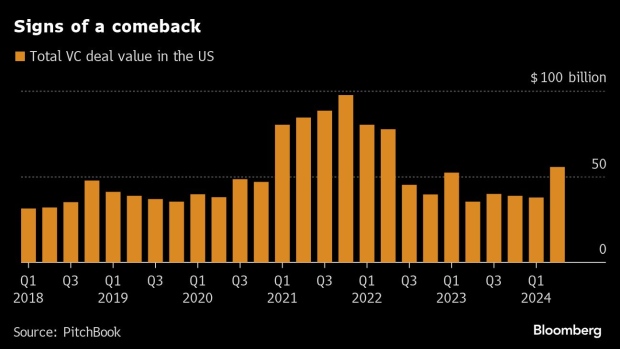

(Bloomberg) -- Venture dealmaking is coming back — at least, for artificial intelligence companies.

Last quarter, US venture capitalists spent $55.6 billion backing startups, up by about half from a year earlier quarter and the spendiest quarter in two years, according to PitchBook data.

But the money went to just 3,108 transactions, the fewest since the second quarter of 2020. The concentration signals that a handful of large AI transactions are skewing the results, including the $1.1 billion raised by AI cloud computing company CoreWeave and the $6 billion raised by Elon Musk’s xAI.

The spending picture partly reflects the subdued fundraising environment. US venture funds raised $37.4 billion across 255 funds in the first half of the year, an uptick from the $33.3 billion raised across 233 funds a year earlier. However, a significant amount of that cash went to a few large players — of the latest total, Andreessen Horowitz raised more than $7 billion, and Norwest Venture Partners and TCV each raised $3 billion.

“Billion dollar funds have been raised, but potentially at the expense of smaller, emerging managers,” PitchBook analysts wrote in an email.

Exits, meaning startups that either got acquired or went public, totaled $23.6 billion for the quarter. That sum, the most in two years, reflects an increase of almost $2 billion over the first quarter, and more than three times the year-earlier quarter.

Globally, deals also trended up, again driven by a handful of large transactions. Global activity totaled $94.3 billion in the quarter, up almost 11% over the year-ago quarter. VCs raised $80.5 billion across 632 funds.

©2024 Bloomberg L.P.