Apr 24, 2024

Boeing’s Revival Roadmap Put to Test by Dwindling Time and Cash

, Bloomberg News

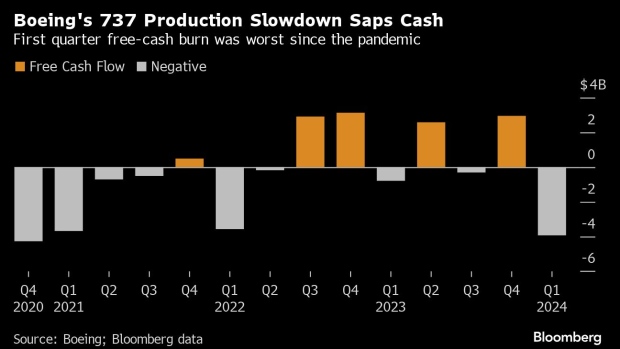

(Bloomberg) -- Boeing Co.’s assurance that it can pull itself together in the next three months is giving rise to two opposing questions: Is that too little time to turn things around — or too long to withstand the financial hemorrhaging?

Chief Executive Officer Dave Calhoun put an optimistic spin on the embattled company’s outlook as he presented Boeing’s earnings on Wednesday, maintaining a mid-decade cash-flow target and predicting a reversal of fortune in the second half.

By then, as Boeing’s timeline goes, the laser focus on quality will yield results and help restore output of its troubled 737 model. While the planemaker faces a “sizable” cash use in the second quarter, it will begin replenishing its reserves again in the latter part of of the year, Boeing Chief Financial Officer Brian West said.

But there are possible risks to the rapid comeback that executives laid out, starting with the company’s dwindling reserves. Boeing burned though $3.9 billion in the first quarter, ending the first three months with $7.5 billion in cash and short-term securities, down from $16 billion at the start of the year.

Asset Purchase

Hours after the Boeing executives laid out their road map, Moody’s Ratings cut the company’s credit rating to one step above speculative grade, with a negative outlook that implies it may soon slip into junk territory. And Moody’s view that headwinds would persist at least through 2026 contrasts directly with Boeing’s assertion that it can turn a corner in a few months.

“Time is an unknown in this entire process,” said Robert Spingarn, analyst with Melius Research. Calhoun “made this sound like a six-month interruption and then they’ll get past it. I agree they’ll get past it, I disagree that it’s that short of a period of time.”

West, the finance chief, said that he intends to protect the company’s investment-grade rating, and that Boeing still has access to $10 billion in untapped credit lines to fortify that flank.

Read More: Boeing Credit Rating on Cusp of Junk After Moody’s Downgrade

But the company is also trying to buy back Spirit AeroSystems Inc., the troubled supplier at the heart of some of its current manufacturing problems. That purchase, which Calhoun said he thinks Boeing can pull off in the current quarter, would cost several billions more, and also requires additional investments to turn the business around.

Besides, Boeing isn’t entirely free to chart its own path ahead. The decision as to when to dial production back up lies with the Federal Aviation Administration, which has stepped up oversight of Boeing in the wake of a near-catastrophic blowout of a fuselage panel on a 737 Max in January. Boeing is due to submit a 90-day plan to the US regulator by the end of May.

“That’s going to be a very important part of them being able to prove to the FAA’s satisfaction that it is acceptable for them to increase their production,” Transportation Secretary Pete Buttigieg told reporters Wednesday. “We’re not going to let them do that until they have satisfied the FAA that they can do it safely.”

New Leader

Calhoun described the FAA’s oversight as “very diligent and businesslike in the way they’ve approached this.” The US regulator has asked Boeing to develop a better set of monitors and measures to assess the performance of its factories and supply chain so that Boeing won’t over-extend production rates.

“And if it ever gets out of control, the signals are clear both to the FAA and to us,” he said.

As a result of its efforts, Boeing is seeing a big drop in 737 fuselages with defective parts since instituting tougher quality controls at the start of March, the CEO said. Over the next 60 days, progress will be “lumpy” while Boeing works through the remaining airframes that were built prior to the new inspection protocols, he said.

Read more: How a Boeing Whistleblower Adds to Company’s Travails: QuickTake

Still, the first-quarter earnings release laid bare the task ahead for whoever succeeds Calhoun once he steps down by the end of this year, with the steep cash burn, a sizable loss at the commercial aircraft subsidiary and much-reduced aircraft production.

The company reported an adjusted loss per share of $1.13, and revenue of $16.57 billion in the first three months. Production of the key 737 jetliner remains well below a cap of 38 a month mandated by regulators while Boeing works on its improvements.

Some analysts remain skeptical that Boeing will be able to meet the tight timeline that executives have sketched out for turning around its production — and finances. The company still hasn’t posted an annual profit, four years after the Covid pandemic added to the squeeze from a global grounding of its 737 Max following two fatal crashes.

“If the pattern of recent years continues, and cashflow doesn’t go according to plan, things could get a little uncomfortable,” said Nick Cunningham, an analyst at Agency Partners.

--With assistance from Allyson Versprille.

©2024 Bloomberg L.P.