Mar 28, 2024

Bud Light Backlash Will Cost Brand Up to 15% of Shelf Space

, Bloomberg News

(Bloomberg) -- Bud Light’s comeback hopes are about to get dashed in the beer aisle.

Major grocery chains are just starting an annual spring rite: reshuffling the alcohol aisle to give more space to top sellers. That reset means fewer feet of shelf space for Bud Light, which hasn’t fully recovered from a conservative-led backlash over its collaboration last year with transgender influencer Dylan Mulvaney.

In the first big shelf reset since Bud Light’s sales nosedived, Anheuser-Busch InBev NV is likely to lose valuable real estate where it can catch consumers’ attention in stores — as much as 15%, according to one estimate.

“Anheuser-Busch’s beers will lose a range of about 10% to 15% of their space nationally as resets start,” said Jesse Ferber, chief strategy officer at Columbia Distributing, which serves Washington and Oregon and works with major retailers including Walmart and Target. Ferber estimates that most of that will come out of Bud Light and Budweiser, based on conversations with national retailers and competing brewers.

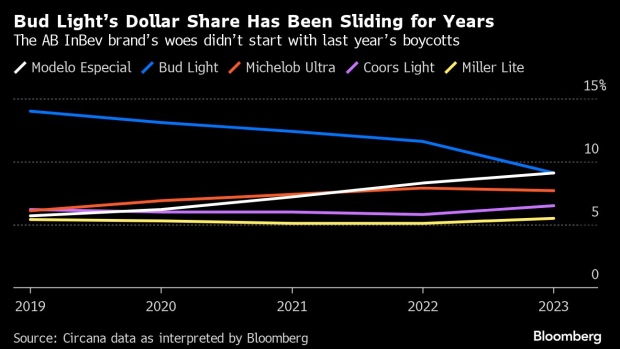

The estimate, while early and informal, suggests the slide the brand has experienced for years could continue. Data from Circana, which tracks retail sales, shows the Mulvaney incident only helped accelerate the ascendancy of a competitor, Constellation Brands Inc.’s Modelo, to surpass Bud Light as the top-selling beer in the US by dollar volume.

Ferber said Anheuser-Busch’s strong portfolio and deep pockets mean it isn’t likely to lose too much brand share. Given regional preferences for beers, some regions might see its brands lose only 5% to 6% of shelf space, while others could see numbers as high as 17% to 18%, he said. Final numbers won’t be known until May or June, he said.

The steep forecast losses align with what a major competitor said it expects to gain.

“We expect our core brands — Coors Light, Miller Lite and Coors Banquet — to grow shelf space by more than 10% in the largest US grocery and convenience retailers this spring over last year,” said Molson Coors Brewing Co.’s president of US sales, Brian Feiro. He called shelf space one of the main “leading indicators of retail success” for beer.

Read More: Bud Light Brewer Wants Focus Back on Beer After Transgender Row

But grocery shelves aren’t the be-all, end-all. Bud Light is also sold widely at bars, restaurants and stadiums. And Anheuser-Busch has just had some major marketing wins, including Olympics and Ultimate Fighting Championship sponsorships, which may help convince retailers to hold space for it. The company also recently averted a strike threat.

Asked how shelf resets are affecting its brands, an Anheuser-Busch spokesperson said Michelob Ultra and Busch Light had gained space with some fall resets, while space for Bud Light was only “moderately reduced.”

“With respect to shelf space, there are typically small shifts across brands during resets,” the spokesperson said, adding that Bud Light and Michelob Ultra are “the top two share-of-space brands in the beer industry.”

Bud Light, a value-priced beer, is still America’s top-selling brand by overall volume sold, Bloomberg Intelligence analyst Kenneth Shea pointed out, citing data from Circana. Overall for beer, while dollar sales have grown slightly from 2022 to 2023, sales by volume have slipped, Circana’s data shows.

Shelf-space losses this spring will build on an unusually volatile year for the beer aisle.

Molson experienced an “unprecedented” shift in shelf resets this year, with more than 50 retailers increasing space for Coors Light and Miller Lite by 6% to 7% last summer and fall, before the usual spring reset season, Feiro said.

Some small retailers, which often shift shelves throughout the year, have already given Bud Light less space.

“We let our customers dictate which products get the best placement in our stores,” said Blake Leonard, president of Stew Leonard’s Wines & Spirits, which sells alcohol in the Northeast. Leonard estimates sales of Bud Light have fallen by about 50% since the marketing incident.

While some Bud Light drinkers have returned, “overall, I think customers found a different option, and they’re happy, so now they’re buying that,” Leonard said. Popular alternatives include canned cocktails as well as drinks containing THC, the psychoactive element of cannabis, she said.

Monthly data from Circana shows customers were spending slightly more on Bud Light again in January.

For some retailers, it’s just too late. “Bud Light numbers are turning back around,” said Steve Tatum, general manager for Bama Budweiser of Montgomery, which distributes to about 700 retailers in three counties of Alabama. “It may be worse than it should be because the numbers are getting better,” he said of the shelf resets. “But that’s the nature of the business. They won’t look at it for another six months.”

©2024 Bloomberg L.P.