Apr 27, 2024

S&P’s Risk-On Momentum Gets Added Boost From Rebounding Profits

, Bloomberg News

(Bloomberg) -- With the quarterly reporting season roughly half over, US corporate earnings have largely lived up to Wall Street’s optimistic expectations even as macroeconomic headwinds linger.

Of the roughly 230 S&P 500 Index firms that have reported, some 81% have delivered upside surprises, data compiled by Bloomberg Intelligence shows. If the figure holds, it would handily best the 10-year average of roughly 75%. Favorable results from Wall Street darlings like Alphabet Inc. and Microsoft Corp. lifted sentiment, even as heavyweight Meta Platforms Inc. failed to shine.

In some ways, this earnings cycle resembles the last one — with the chatter around artificial intelligence and the focus on sticky inflation and corporate margins. Yet the backdrop has morphed. Geopolitical tension and fading hopes for Federal Reserve interest-rate cuts have helped drive the S&P 500 down almost 3% this month. In the face of that, Corporate America has offered crucial support for the market.

“At a time where expectations for corporate earnings were lofty, and we’ve already absorbed the fact the Federal Reserve isn’t going to cut seven times — those two things together have renewed debate over how bullish we should be,” said Scott Helfstein, head of investment strategy at Global X. “But in the end, that’s where I get back to that headline: corporate profitability has leveled up.”

Here’s are five takeaways from earnings season so far:

Stockpickers’ Time

Traders, by and large, expect stocks will move out of sync with one another, bringing opportunities to pick winners and losers. While a measure of implied correlations among the 50 largest S&P 500 firms has risen in recent months, the bounce is from a historically low level.

Some of the divergence can be chalked up to the relative performance of various sectors. For example, while analysts expect earnings-per-share growth in communication services and information technology, they project contractions for energy and materials, data compiled by Bloomberg Intelligence shows.

“When the correlations are high, it’s very difficult for active management,” said Don Nesbitt, senior portfolio manager at ZCM. “A low correlation is what you want for a stockpicker.”

Down Days

Corporate results have usually served as a cornerstone of the market’s advance. This century, the S&P 500 has gained during two-thirds of earnings seasons, with losses during that time almost always happening for a clear reason, like the escalation of trade tension with China, data compiled by Bloomberg show.

This cycle is on track to defy the typical pattern: The S&P 500 is down 1.9% since the morning of April 11, when JPMorgan Chase & Co. and other big banks kicked off earnings.

Tech Swings

Investors have underestimated how much Big Tech shares would move after their results. Of the four Magnificent Seven firms that have reported — Tesla Inc., Meta, Microsoft and Alphabet — three have posted next-day moves that surpassed what options implied.

Before the reports, traders were bracing for somewhat subdued swings relative to what the shares did in past seasons. As Citigroup Inc.’s Stuart Kaiser sees it, bullish outlooks for the AI champions may have led to lower implied moves. But the big leaps thus far could stoke expectations for more notable swings ahead.

“There’s a chance that those later reporters have a lower likelihood of beating the implied move just because people have had a chance to reassess,” Kaiser said.

Margin Recovery

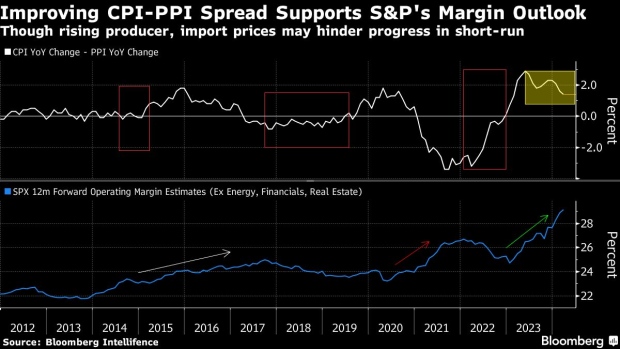

Consumer prices have grown more quickly than producer prices in recent quarters. That’s helped support a recovery in S&P 500 margins amid corporate cost-cutting that’s also helped drive profits higher.

Margins are a key gauge of profitability that historically offers a signal on where a stock is headed. Wall Street sees S&P 500 margins for the first quarter at about 14%, up from below 12% in early 2020, with forecasts for improvement in the coming quarters, data compiled by BI show.

That said, rising producer prices may erode the progress on margins, says Gina Martin Adams, chief equity strategist at BI.

“Keep a close eye on margins,” she said. “We saw signs of stabilization in the past year, but now rising commodity prices are eroding margin improvement for some sectors, which isn’t something that’s been embedded in analysts’ expectations.”

Bank Questions

The big lenders delivered somewhat mixed results. JPMorgan and Wells Fargo & Co. kept guidance conservative, while Goldman Sachs Group Inc. rallied the day of its release.

Over the coming months, loan growth is expected to remain muted. For this reporting period, analysts expect banks’ earnings per share to contract roughly 6% year-over-year, data compiled by BI show.

But RBC’s Gerard Cassidy, in a note, said sentiment remains “constructive” on the group, and says some of the worst pressures are behind it. Traders appear to agree, as demand to hedge against losses in shares of large and regional banks has declined lately.

--With assistance from Matt Turner, Bre Bradham and Elena Popina.

©2024 Bloomberg L.P.