(Bloomberg) -- Bank of Canada surveys show business and consumer expectations for inflation are subdued, keeping the door open for further rate cuts in coming months.

The surveys — released Monday in Ottawa — point to slowing growth in firms’ input and selling prices amid a weaker economic backdrop. Policymakers said this supports their view that inflation will continue to ease over the next 12 months.

Traders increased bets that policymakers will cut the policy interest rate next Wednesday, putting the odds at around 80%.

“Firms’ expectations for inflation fell in June and are now in the Bank of Canada’s inflation-control range,” the central bank said in the document. The bank’s consumer survey shows similar results — short-term inflation expectations are starting to ease.

Businesses say their sales outlook is little changed from the last quarter, with firms expecting “soft demand” in the future, according to the survey of companies. Overall, the central bank’s business outlook indicator fell to minus 2.9 in the second quarter, from minus 2.4 previously.

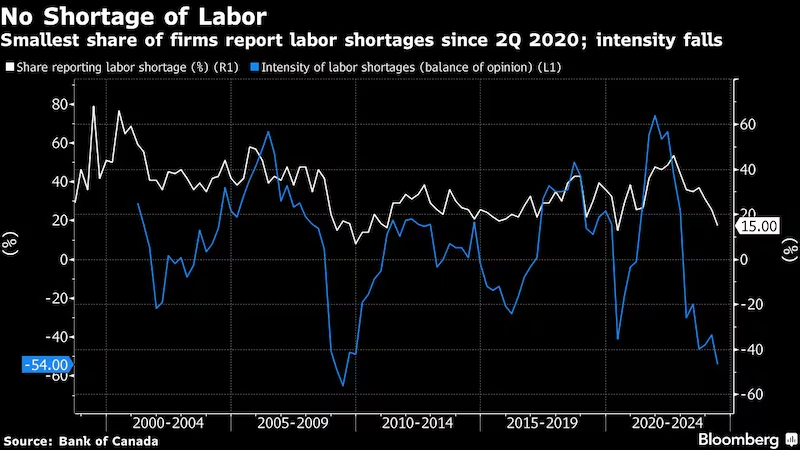

The share of firms reporting labor shortages is near a record low, and businesses’ expectations for wage increases over the next year have slowed, the bank said. Overall, capacity constraints “have returned close to their historical average.”

“The Business Outlook Survey suggests a pretty dovish economic backdrop, and they can point almost any section of that report to justify cutting rates again at the upcoming meeting,” Andrew Kelvin, head of Canadian and global rates strategy at TD Securities, said by email.

Both surveys were conducted before the Bank of Canada cut the policy rate to 4.75% at its June 5 meeting and signaled more easing to come if disinflation continued. In the business outlook survey, firms said they expect rates to decline by 0.5 to 1 percentage points in the next 12 months.

Investment plans remain weak, the survey data show, and more firms say their spending plans aim to replace machinery and equipment than improve productivity or output. Businesses’ top concerns have shifted to taxes and regulations, though uncertainty and cost pressures remain important issues.

About a fifth of firms are expecting a recession in the next year, less than in the previous quarter, the bank says.

“The ongoing softness in the economic backdrop and increasing slack in the labour market are supportive of further cuts from the Bank of Canada,” Benjamin Reitzes, rates and macro strategist at Bank of Montreal, said by email.

On Tuesday, Statistics Canada releases inflation data for June, the last major print before the central bank sets rates next week. A slim majority of economists surveyed by Bloomberg expect policymakers to hold rates steady.

The bank flagged that respondents to the consumer survey still think that domestic factors, including fiscal policy and elevated housing costs are “contributing to high inflation.” Home-buying intentions are near historical averages, the bank said, and are supported by “strong plans” among newcomers to buy homes.

©2024 Bloomberg L.P.