Mar 27, 2024

A Turbocharged Bitcoin ETF Is More Popular Than TSMC in Korea

, Bloomberg News

(Bloomberg) -- A risky exchange-traded fund in the US that aims to deliver twice the daily performance of short-term CME Bitcoin futures is seeing strong demand from Korean investors.

The VolatilityShares’ 2X Bitcoin Strategy ETF — ticker BITX — aims to generate exceptionally high returns, thanks to an effect known as “leverage compounding.” On the flip side, it suffers from “volatility drag” which may hurt investors over the long term.

The investment product is proving especially popular in South Korea, where investors have plowed a net $122 million into BITX so far in March. That makes it the fifth-most bought foreign security in South Korea this month, just below Tesla and above American depositary receipts for semiconductor maker TSMC, according to Korea Securities Depository data.

Crypto-linked investments have been a popular choice for Koreans in general. Michael Saylor-backed MicroStrategy ranks as the third most popular foreign security in March, while ProShares Bitcoin Strategy ETF (BITO), another futures-based product, was 22nd on the list.

“Korean investors seem to be approaching BITX as an alternative to Bitcoin spot ETF, which is blocked in the country,” said Subeen Shim, digital asset analyst at Kiwoom securities in Seoul. “Rising Bitcoin prices also contributed to the move.”

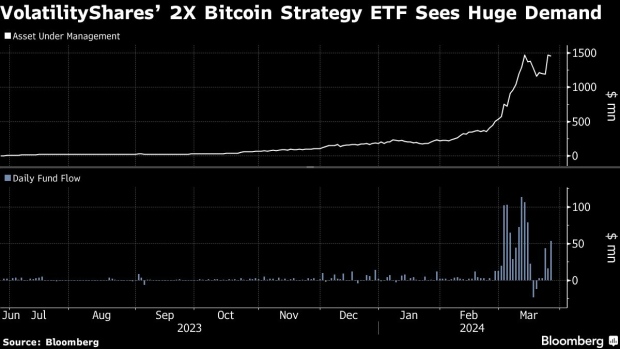

BITX, the first leveraged crypto ETF in the US, has seen massive demand since the launch of US spot Bitcoin ETFs on Jan. 11. In March alone it has drawn $834 million of inflows, trailing only Fidelity and BlackRock’s spot ETFs. Of its March inflows, $52 million came on Tuesday alone, data compiled by Bloomberg show.

BITX’s assets under management reached a record high of $1.47 billion on Monday as the largest cryptocurrency again started rallying after last week’s correction.

“Like most leveraged ETFs, BITX is designed for aggressive traders that are comfortable with high levels of volatility,” Sumit Roy, senior analyst at ETF.com, told Bloomberg over email. He added that leveraged ETFs “should only be held for short periods of time” because daily re-balancing can, after a while, lead to losses.

“The more volatile the asset, the bigger this decay is. Bitcoin being an extremely volatile asset makes this a significant risk,” Roy said.

The increasing interest in such funds has prompted a flurry of new offerings. Valkyrie’s BTFX is a competing product that is already live, while ProShares, Direxion and T-Rex have filings with the US Securities and Exchange Commission to launch leveraged Bitcoin ETFs of their own.

It is not unusual for ETF issuers to develop their products in this order, according to Stephane Ouellette, CEO at FRNT Financial. Leveraged funds offer a path for smaller providers to “develop a brand in the more structured-ETFs,” he added, while larger asset managers benefit from demand for spot products.

Bitcoin reached a new record of $73,798 earlier in March on the back of strong demand for spot ETFs tracking the token in the US, which have collectively seen a net inflow of $11.7 since launch.

©2024 Bloomberg L.P.