Feb 1, 2023

China Battery Giant CATL Weighs $5 Billion Swiss GDR Sale

, Bloomberg News

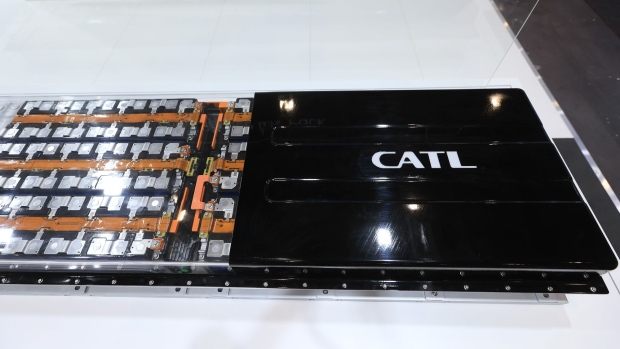

(Bloomberg) -- Contemporary Amperex Technology Co. Ltd., the world’s biggest maker of batteries for electric cars, has chosen banks for its sale of global depositary receipts in Switzerland to raise at least $5 billion, according to people familiar with the matter.

The Chinese giant is working with China International Capital Corp. and China Securities International on the share sale, the people said, asking not to be identified as the information is private. CATL has also picked Goldman Sachs Group Inc. and UBS Group AG for the GDR sale, the people said.

The listing could happen as soon as this year, said one of the people. Deliberations are ongoing and details of the GDR sale could still change, they said.

Representatives for CICC, Goldman Sachs and UBS declined to comment, while CATL and China Securities didn’t immediately respond to requests for comment.

CATL would be joining other Chinese companies in tapping the European market as lingering geopolitical risks and regulatory woes reduce the appeal of other offshore markets like the US. At $5 billion, the GDR would be the biggest such issuance by a Chinese company, according to data compiled by Bloomberg. IFR first reported the Swiss listing plans.

Read more: Chinese Listings in Europe Poised to Speed Up in 2023

CATL accounts for the largest share of the global electric-vehicle battery market, according to data from Seoul-based SNE Research. It sold a total of 165.7 gigawatt-hours of batteries in the January-November 2022 period, almost three times as much as second-placed BYD Co., a Chinese automaker that also manufactures batteries.

CATL’s market share was about 35% in the first 10 months of last year. The Fujian-based company supplies carmakers including Volkswagen AG, Geely Automobile Holdings Ltd., Nissan Motor Co. and Tesla Inc., which delivered fewer EVs than expected last quarter, despite offering some price cuts.

In 2017, CATL raised about $822 million in an initial public offering in Shenzhen. The company raised another 45 billion yuan ($6.7 billion) in a private share placement last year. China Securities was the lead sponsor, while CICC, Goldman Sachs and UBS were among the co-lead underwriters.

Shares of CATL have fallen about 18% in the past year, valuing the company at about $172 billion.

--With assistance from Danny Lee, Amanda Wang and Cathy Chan.

(Updates with banks in first three paragraphs.)

©2023 Bloomberg L.P.