Apr 17, 2024

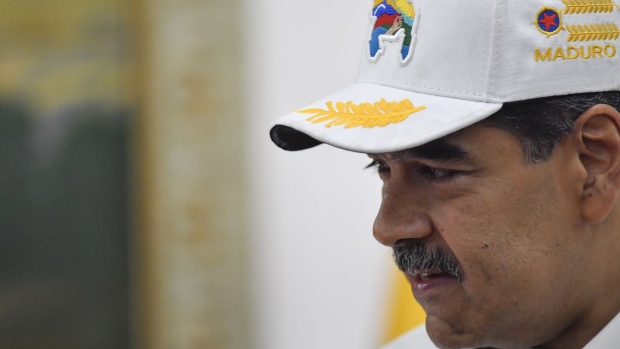

US to Reimpose Venezuela Oil Ban Unless Maduro Acts Quickly

, Bloomberg News

(Bloomberg) -- President Joe Biden’s administration reimposed oil sanctions on Venezuela, ending a six-month reprieve after determining that Nicolas Maduro’s regime failed to honor an agreement to allow a fairer vote in elections scheduled for July.

The Treasury Department license that permitted some oil and gas activities will expire, and the affected companies will have until May 31 to wind down operations, according to a document posted Wednesday on the agency’s website. The ruling doesn’t apply to Chevron Corp., a significant producer in Venezuela through joint ventures with the state oil company, allowing it to continue operating.

US officials said sanctions relief depended on Maduro meeting the terms of an agreement to allow inclusive and competitive elections. They determined that while some Venezuelan authorities met aspects of the deal, Maduro did not fully comply with the its spirit, citing moves to exclude some opposition candidates from running.

The Biden administration had sought to buy as much time as possible before finalizing the decision in hopes of an unlikely breakthrough, people familiar with the decision said earlier Wednesday. The people, who asked not to be identified to speak publicly, had said the sanctions would be reimposed in the absence of any concessions from Maduro ahead of a Thursday deadline.

Possibilities for a last-minute resolution that had been mentioned in recent days included the government extending the deadline for registering candidates, or the opposition throwing its support behind Manuel Rosales, a governor who was allowed to register but is distrusted by some for his willingness to negotiate with Maduro.

The US granted the relief in October after Maduro’s representatives traveled to Barbados to sign an agreement to take steps toward a free and fair election. Since then, Maduro has consistently tested the limits of the deal, barring Maria Corina Machado, who won an October opposition primary, and a proposed substitute from running. Maduro has brutally repressed protests against his decade-long rule, including arresting human-rights leaders and opposition officials.

Also Read: Venezuela Oil Sanctions Threat Endangers a Price Buffer

Wednesday’s decision means companies that started buying Venezuelan crude and conducting other oil-related activities during the six-month reprieve can no longer do so without requesting a license from the US. Confirmed purchasers during that period included India’s Reliance Industries and commodity trading house Vitol Group. Firms can apply for specific licenses which would be evaluated on a case-by-case basis.

Asked whether Chevron’s license would also be under review, an official said that predated the Barbados agreement and provided a baseline for the talks to start. Italy’s Eni SpA and Spain’s Repsol SA also had waivers predating the Barbados accord, allowing them to lift Venezuela crude to offset natural gas-related debts.

“We reiterate our commitment to conducting our business in compliance with laws and regulations where we operate, as well as with US laws and regulations,” Chevron said in a statement.

A US official said the focus was on the political situation in Venezuela when asked about the impact on gas prices. Officials said they were also aware the economic situation in Venezuela had contributed to record levels of migration and were working with other nations to address that issue.

The officials said the decision to reimpose sanctions should not be viewed as a final judgment on the prospects that Venezuela may agree to hold competitive elections in the future, adding that they would continue to monitor the political process and maintain communication with the opposition.

Economic Impact

Reimposing sanctions ends a brief respite that saw foreign oil executives flock to the South American nation. Renewed sanctions threaten to set back Maduro’s efforts to restart Venezuela’s economy, which requires significant foreign investment to rebuild its decaying oil infrastructure.

Sanctioning the nation’s limited production will bear little immediate impact on the global oil market. But over the medium- to long-term, the lack of investment from Chevron and other outside investors could ultimately see Venezuela’s oil output decline.

Maduro welcomed international oil majors to scout for deals with state-owned Petroleos de Venezuela SA in the hopes of boosting production. The temporary license gave Maduro an additional $740 million in oil sales from October until March, according to an estimate from Eduardo Fortuny, head of Caracas-based consultancy Dinamica Venezuela.

Venezuela’s oil minister, Pedro Tellechea, sought to downplay the impact, saying the US decision would not affect the country’s economy and oil companies can still seek new licenses to work with Petroleos de Venezuela.

Bond prices had been rising for the past two weeks as expectations over a resolution to the political stalemate grew. They reached a peak in January as investors increased their holdings in anticipation of Venezuela’s inclusion in the widely followed JPMorgan Chase & Co. emerging-market indexes this year. Bonds across the curve rose in January with 2027 sovereign notes touching a high of 23 cents on the dollar, according to data compiled by Bloomberg. The debt has been sliding since, and fell about 0.5 cent on Bloomberg’s report Wednesday, according to traders.

Cracking down on oil from the country also threatens to send rising US gasoline prices even higher, a danger for Biden, who has struggled to address voter anxiety over high inflation ahead of his November rematch with Republican Donald Trump.

The Biden administration also worried revoking the license could worsen the economic crisis in Venezuela, the second-largest source for undocumented migrants encountered at the US-Mexico border last year — another election-year issue.

--With assistance from Fabiola Zerpa, Patricia Laya, Andreina Itriago Acosta and Maria Elena Vizcaino.

(Updates with Chevron comment in the ninth and 10th paragraphs. An earlier version corrected the date of a Treasury Department letter in the second paragraph.)

©2024 Bloomberg L.P.