Apr 10, 2024

U.S. inflation refuses to bend, fanning fears it will get stuck

, Bloomberg News

U.S. inflation higher than expected in March: instant reaction

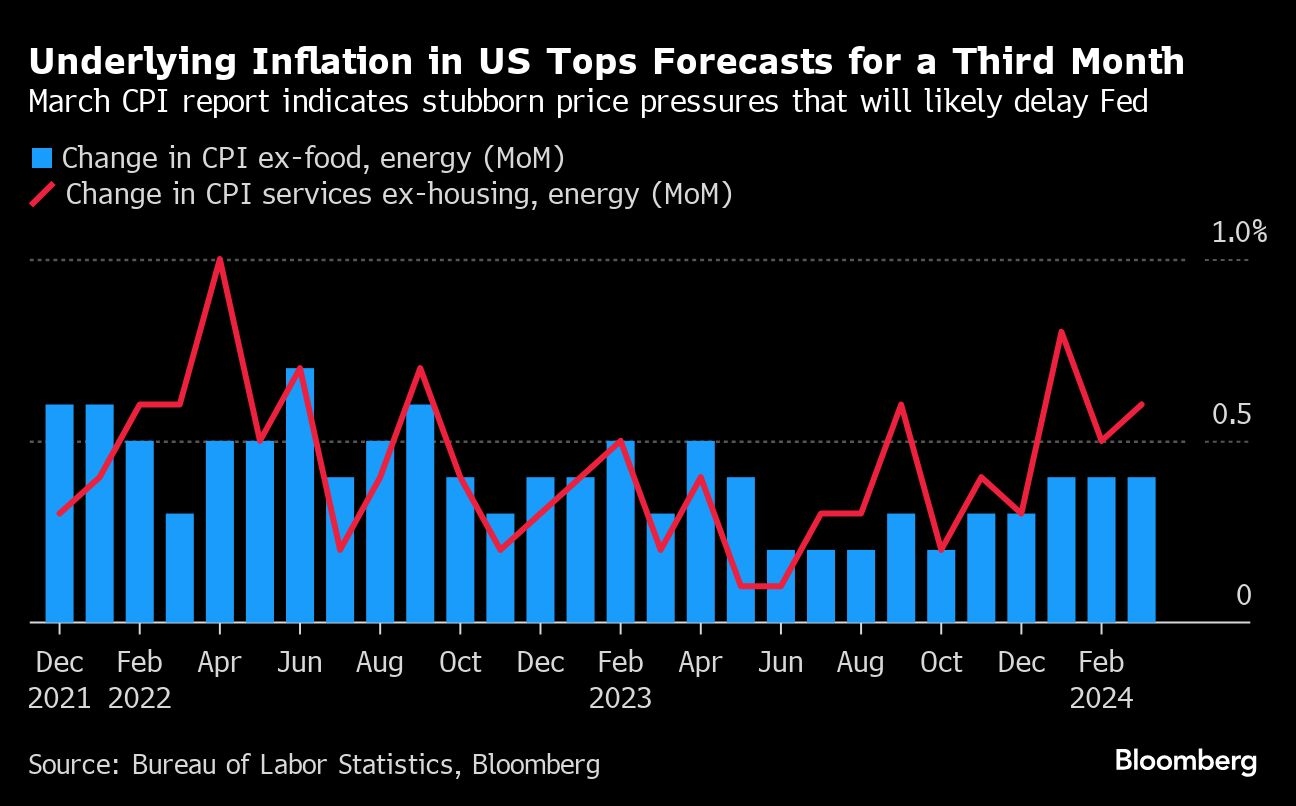

A key U.S. price gauge topped forecasts for a third straight month on gains in rents and transportation costs, spurring concerns that inflation is becoming entrenched as the economy keeps powering ahead.

The so-called core consumer price index, which excludes food and energy costs, increased 0.4 per cent from February, according to government data out Wednesday. The year-over-year rate was unchanged at 3.8 per cent, defying expectations for a downtick.

Financial markets were roiled by the numbers, which ignited the U.S. dollar and Treasury yields and sent the stock market tumbling. Paired with recent reports showing the labor market and economic activity have also been stronger than expected, investors no longer see much chance that the Fed will feel a need to start easing anytime soon.

“The sound you heard there was the door slamming on a June rate cut. That’s gone,” David Kelly, JPMorgan Asset Management’s chief global strategist, said on Bloomberg Television.

Wednesday’s U.S. Bureau of Labor Statistics report revealed ongoing strength in rents, the largest components of the CPI. Forecasters have long been awaiting a deceleration based on leading indicators, but progress has more or less stalled over the past nine months.

Services inflation, meanwhile, accelerated — largely thanks to categories tied to transportation like car insurance and repairs, as well as health care. Core goods prices were a bright spot, resuming a downward trend that helped drive disinflation in the second half of 2023.

One important caveat: Many of the sources of strength in the March CPI data, like rents and auto insurance, will be more muted in the Fed’s preferred gauge, known as the personal consumption expenditures price index. That’s because they’re weighted less heavily in that report, which comes out later this month.

Still, the numbers were enough to completely reorder bets on the timing of Fed rate cuts. Before the report, traders were assigning roughly even odds to a first cut in June, according to futures. The chances of such a move dropped to about one in five afterward, and December is now the first month showing better-than-even odds of a cut.

What Bloomberg Economics says...

“The Fed is likely to take a stronger signal that disinflation momentum is slowing from this report. We push back our expectation for a first rate cut to July, from our previous baseline of June.”

— Anna Wong and Stuart Paul.

Higher-for-longer interest rates may pose fresh challenges to President Joe Biden’s re-election campaign. Higher gasoline prices won’t help either.

While economists see the core gauge as a better indicator of underlying inflation than the overall CPI, the latter measure climbed 0.4 per cent from the prior month and 3.5 per cent from a year ago, marking an acceleration from February that was boosted by rising energy costs.

A separate report Wednesday, combining the inflation data with figures on wages published last week, showed real earnings growth decelerated, rising at the slowest annual pace since May.

Fed officials will see one more PCE report, as well as another look at the producer price index, before their next policy meeting concludes on May 1, though they’ve already effectively ruled out a rate cut then.

“Even though the Fed doesn’t target CPI, it is another reason for delaying any rate cuts and/or reducing the number expected this year,” said Kathy Jones, Charles Schwab’s chief fixed-income strategist. “If service-sector inflation is sticky, then it doesn’t leave much room to ease.”