Apr 26, 2024

Soaring Imports of Green Diesel Feedstocks Disrupt US Soy Market

, Bloomberg News

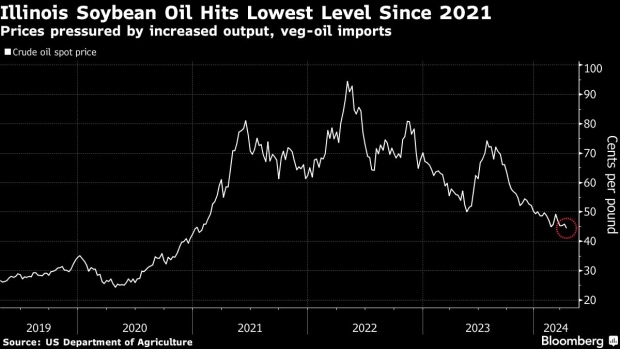

(Bloomberg) -- A surge in imports of used cooking oil and other ingredients for biofuel production in the US is eroding profits for soybean processors, forcing them to slow down and jeopardizing expansion plans.

Faced with weaker demand, companies are starting earlier than usual on seasonal maintenance, closing plants for longer periods. Some 20 million bushels (540,000 tons) of crush capacity were offline across the Corn Belt in April — a record for the month — including at big plants from Archer-Daniels-Midland Co. and Cargill Inc., according to CrushTraders. At least 10 million bushels are set to be turned off in May.

That’s a worrying sign for an industry that has invested billions of dollars to expand capacity in turning soybeans into oil, which then can be used to make renewable diesel. While government incentives have created booming demand for cleaner-burning fuels from sources such as farm crops, foreign shipments of alternatives including imported tallow, used cooking oil and canola oil are cannibalizing soybean oil’s market share.

The increased competition is raising questions about how much capacity will be needed going forward.

“Those projects that were well under way are going to continue and get completed,” John Neppl, chief financial officer of Bunge Global SA, the world’s largest processor of oilseeds, said Wednesday in a conference call with analysts. “But really, anything that was proposed or in early stages, we’ve seen a number of those put on hold.”

Soyoil accounted for 32% of the feedstocks used to produce biodiesel in January, down from 44% a year earlier and a record low. That’s partly because soyoil isn’t very competitive against the alternative sources, which are cheaper and have lower carbon-intensity scores, allowing for higher subsidies.

“The US soy processing industry is grappling with growing pains” due to the challenges from these alternatives, said Susan Stroud, a grain analyst for No Bull Ag in St. Louis.

At the same time, the number of renewable diesel plants is growing, reaching 539 in January, up from 384 a year earlier.

Soybean processors have 21 projects outstanding to expand capacity in the US, according to Gordon Denny, an agricultural consultant and former procurement director at Bunge. From those, five projects start this year and will compete for the new crop that begins to be harvested in October. That will create an additional 495,000 bushels a day in extra processing capacity to compete for the new oilseeds.

“This increase in crush capacity, plus the use of other feedstocks to produce renewable diesel, are creating a surprise lack of demand for soyoil,” said Denny.

Neppl said that the Environmental Protection Agency should review its rules that determine how many gallons of biofuel refiners are obligated to add to the US motor fuel mix. Those requirements are part of the Renewable Fuel Standard, aimed at curbing climate-harming greenhouse gases and bolstering US energy security.

Crush margins — which reached decade-high levels in 2022 and 2023 — are being further pressured with the return of Argentina to the exporting market following a historical drought, as well as by rising stocks of soyoil. In March, oil stocks reached 1.85 billion pounds, with the increase from February being a record high, according to Stroud.

Competition will get tougher during the harvest in the fall, when more crush plants will start operating. As a result, companies are weighing their options on how much capacity to bring back online.

“Smaller margins play into the downtime, but companies are also taking their time after running as much as they could in 2022 and 2023,” said Kent Woods, owner of CrushTraders. “The market is realistic it will get challenging as we move forward.”

--With assistance from Kim Chipman and Michael Hirtzer.

©2024 Bloomberg L.P.