Apr 16, 2024

Russian Crude Shipments Surge to the Highest in Almost a Year

, Bloomberg News

(Bloomberg) -- Russia’s seaborne crude exports soared to an 11-month high in the second week of April with flows from all major ports near peak levels.

Last week’s jump propelled total weekly flows to the highest since May 2023, for a level that has been exceeded only twice since the start of 2022, vessel-tracking data compiled by Bloomberg show. The less volatile four-week average also rose sharply, climbing to the highest since early June.

Weekly shipments were well above a target for this month that’s part of the OPEC+ alliance’s broader effort to curb supplies and support prices.

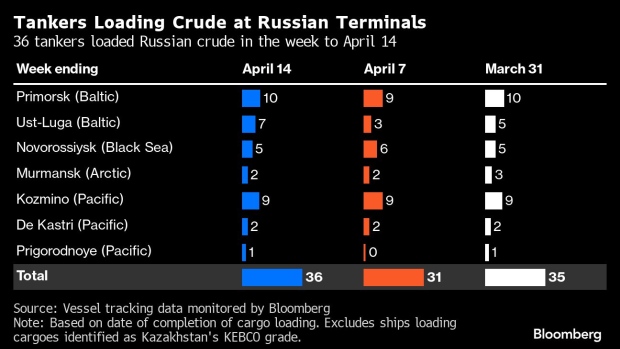

Cargoes from Primorsk, Ust-Luga, Novorossiysk and Kozmino were close to historical highs. Primorsk on the Baltic handled 10 tankers in three of the past four weeks, possibly reflecting a diversion to exports of crude that would have been processed at refineries hit by Ukrainian drones. The port hasn’t handled more than 11 tankers in a week in data back to the start of 2022. Refining rates are languishing near an 11-month low as repairs continue.

The jump in flows, combined with higher Urals crude prices, boosted Moscow’s oil earnings. The gross value of crude exports rose to $2.15 billion in the seven days to April 14 from $1.82 billion previously. Four-week average income added about $170 million to $1.92 billion a week.

Separately, four-week average shipments to Asia continued to climb, following a similar pattern to that seen at the same time last year. Then, shipments to Asia — predominantly China and India — peaked at 3.6 million barrels a day in the four weeks to May 14, before dropping by about 1 million barrels a day over the following three months.

The backlog of Russia’s Sokol crude that built up after being turned away by Indian refiners has now almost disappeared. About 9.1 million barrels, half of the total, have been delivered to refineries in China. Another 7 million barrels are finding their way back to India. Two cargoes have been delivered to Pakistan.

That leaves just 1.4 million barrels still to show a destination, with another 700,000 barrels in a tanker that’s been anchored off India’s east coast since the start of April. All of the Sokol cargoes loaded since mid-February headed directly to China.

Flows by Destination

Russia’s seaborne crude flows in the week to April 14 surged by 560,000 barrels a day to 3.95 million, reaching the highest since May 2023. The less volatile four-week average also soared, up by about 250,000 barrels a day to 3.66 million, to the highest since June.

Weekly shipments were about 365,000 barrels a day higher than the average seen in May and June, or about 490,000 barrels a day above Russia’s April target, which is part of the OPEC+ alliance’s broader effort to curb supplies and support prices. The four-week average was about 200,000 barrels a day above the target.

Russia said it would cut crude exports during April by 121,000 barrels a day from their average May-June level as part of the wider OPEC+ initiative, as Moscow shifts more of the burden onto production targets, which are preferred by other members of the group. Seaborne shipments in the first three months of the year exceeded Russia’s target level by just 16,000 barrels a day.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Black Sea port of Novorossiysk and the Baltic’s Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

-

Asia

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose to 3.34 million barrels a day in the four weeks to April 14, up from 3.09 million in the previous four-week period, to the highest since June 2023.

About 1.36 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.53 million barrels a day.

Both the Chinese and Indian figures will rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 365,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 80,000 barrels a day in the four weeks to April 14, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece, or more recently off Sohar in Oman.

Europe and Turkey

Russia’s seaborne crude exports to European countries have ceased.

With flows to Bulgaria halted at the end of last year, Turkey is now the only short-haul market for shipments from Russia’s western ports.

Exports to Turkey were stable at 323,000 barrels a day in the four weeks to April 14, down from 400,000 barrels a day in the period to March 31.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Value

Following the abolition of export duty on Russian crude, we have begun to track the gross value of seaborne crude exports, using Argus Media price data and our own tanker tracking.

The gross value of Russia’s crude exports soared to $2.15 billion in the seven days to April 14 from $1.82 billion in the period to April 7. Four-week average income was also up, rising by about $170 million to $1.92 billion a week. The four-week average is still below its peak of $2.17 billion a week, reached in the period to June 19, 2022. The highest it reached last year was $2 billion a week in the period to Oct. 22.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

The chart above shows a gross value of Russia’s seaborne oil exports on a weekly and four-week average basis. The value is calculated by multiplying the average weekly crude price from Argus Media Group by the weekly export flow from each port. For shipments from the Baltic and Arctic ports we use the Urals FOB Primorsk dated, London close, midpoint price. For shipments from the Black Sea we use the Urals Med Aframax FOB Novorossiysk dated, London close, midpoint price. For Pacific shipments we use the ESPO blend FOB Kozmino prompt, Singapore close, midpoint price.

Export duty was abolished at the end of 2023 as part of Russia’s long-running tax reform plans.

Ships Leaving Russian Ports

The following table shows the number of ships leaving each export terminal.

A total of 36 tankers loaded 27.6 million barrels of Russian crude in the week to April 14, vessel-tracking data and port agent reports show. That was up by about 3.9 million barrels from the previous week and the highest weekly total since May 2023.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. No cargoes of KEBCO were loaded during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. Weeks run from Monday to Sunday. The next update will be on Tuesday, April 23.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

©2024 Bloomberg L.P.