Apr 18, 2024

Nordea Again Posts Net Interest Income Growth, Beating Estimates

, Bloomberg News

(Bloomberg) -- Nordea Bank Abp reported record profits in the first quarter as the tailwind from interest rates continues to lend support to the largest lender in the Nordic region.

Net interest income — or the difference Nordea earns from lending and pays for deposits — increased to €1.95 billion ($2.1 billion) for the three months through March, it said on Thursday. That pushed quarterly net income to an all-time high of €1.36 billion.

The results from the first EU bank to report first-quarter earnings indicate that the bloc’s banks are still reaping the benefits from the interest-rate hikes kicked off by the European Central Bank almost two years ago, which have boosted what they earn on lending while the rates they pay on deposits have risen much more slowly. The effect is expected to taper off eventually as the ECB may start cutting rates soon while competition between banks drives up how much they have to offer to attract savers.

Some analysts expressed disappointment that Nordea didn’t provide fresh details on when it plans to return money to investors through the next share buyback. The lender said it wants to wait until its top regulator, the ECB, has approved some of its new risk models.

“The timing around capital return is a little underwhelming,” Hari Sivakumaran, an analyst at Keefe Bruyette & Woods, said in a note. “We had been expecting buybacks to be announced sooner.”

The decision not to provide fresh information on the next buyback “changes nothing in terms of our attitude to capital returns,” Chief Financial Officer Ian Smith said on a call with analysts. “This is just being respectful of our relationship to our regulator.”

Nordea has bought back €5.5 billion worth of its own stock since late 2021. It concluded a fourth share buyback program, worth €1 billion, in February.

Nordea’s shares opened 1% higher and were trading 0.6% up at 12:24 p.m. in Helsinki.

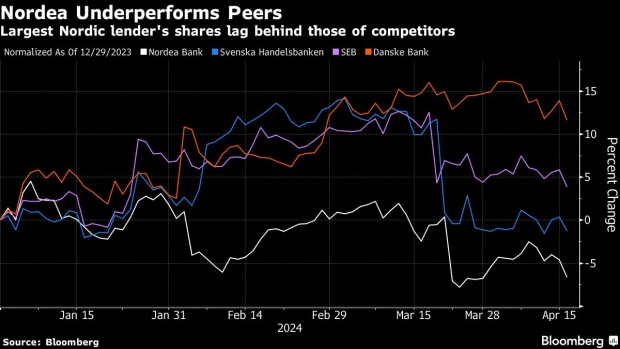

The bank’s shares have retreated this year and performed worse than those of its Nordic peers, partly after fourth-quarter results underwhelmed.

The net interest income increase in the first quarter was driven by improved deposit margins, higher corporate lending volumes and higher treasury income, Nordea said. It was partly offset by lower lending margins.

Nordea’s net loan losses hit €33 million in the first quarter and it still has a buffer of about €500 million to cover potential future losses. The bank previously flagged such losses will start to “normalize” over time, saying near-zero levels are not sustainable in the long run.

“The result was strong with revenues and costs both better than expected and supported with lower impairments,” Jefferies International Ltd. analysts Alexander Demetriou and Joseph Dickerson said in a note.

--With assistance from Christopher Jungstedt and Anton Wilen.

(Updates with CFO comment in sixth paragraph)

©2024 Bloomberg L.P.