Apr 19, 2024

Latin America Sees Low-Rate Dreams Crumble and Political Woes Rise

, Bloomberg News

(Bloomberg) -- The region that led the world into a promising cycle of interest rate cuts is warning that delays to the Federal Reserve’s own monetary easing pose a threat to its economic recovery, potentially exacerbating domestic political problems.

Latin American central bankers were first and aggressive when raising rates to fight post-pandemic inflation, and again first to start cutting them, hoping their decisive action would provide a boost to regional economies that are often plagued by mediocre growth. But this week at the International Monetary Fund’s meeting in Washington, they were more somber.

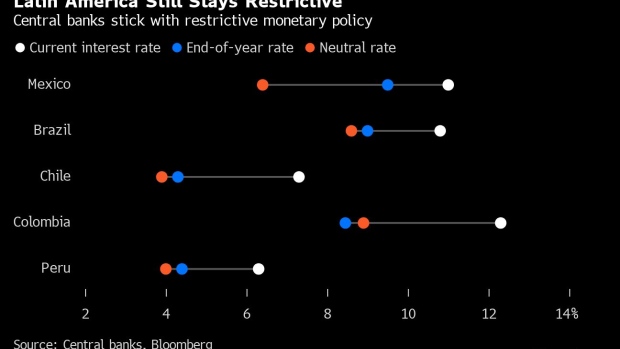

Countries such as Brazil and Chile are signaling the floor to their rate cuts could come sooner, considering the need for a yield differential wide enough to avoid damaging currency depreciations. Others with more fat to burn, like Colombia and Mexico, are ruling out hastier cuts. While that’s a challenge for all central banks, it’s particularly damaging for a region that is again lagging the developed world, with 2024 growth estimated at only 1.6% by the World Bank.

“The risk now is that monetary policy sacrifices growth more than necessary,” said Jose de Gregorio, a former Chile central bank president. Policymakers are “worried about their ability to sustain lower rates.”

Read more: World Bank Cuts Latin America Growth Forecast and Warns of Crime

The timing couldn’t be worse for heads of state who are also grappling with high debts and limited room for spending. There is a risk central bankers who put the brakes on monetary easing become scapegoats for a lack of improved well-being that presidents have promised.

In some countries, the finger-pointing is well underway. Brazil’s Luiz Inacio Lula da Silva has revived criticism of central bank chief Roberto Campos Neto following a period of relative calm, describing him as an obstacle to economic prosperity. President Gustavo Petro often pans Colombia’s policymakers, and his finance minister is pressuring for bigger rate cuts.

“Almost everywhere you look there are economic headwinds detracting from presidents’ popularity,” said Cynthia Arnson, a Latin America political analyst at the Wilson Center, a think tank in Washington. “They have much less room to maneuver than almost at any other time.”

Pace Reduction

With inflation plunging from a three-decade high, Chile thrust Latin America to the forefront of global rate cuts last July with a full-percentage point reduction. Brazil, Peru, Colombia and Mexico followed suit, though with smaller drops.

Read more: World’s Biggest Rate Cuts Coming After Chile Tamed Inflation

Still, Mexican central banker Irene Espinosa said this week that policymakers’ inflation forecasts have “credibility issues,” and that it’s too soon to mull a prolonged easing cycle. Chile and Colombia are questioning the appropriate pace of rate cuts as risks rise, while Brazil’s Campos Neto went as far as laying out a scenario that could curtail reductions.

“We could have a system in which the uncertainty continues to be very high, but doesn’t change significantly, which might mean a reduction in pace,” Campos Neto said on Wednesday while discussing doubts in the global economy.

At the heart of central bankers’ concerns are currencies that have sunk due to shrinking differences between regional interest rates and the US, which makes it less attractive for investors to park their money in Latin America. A weaker exchange rate consequently fans price pressure by raising import costs.

The worst case is the Chilean peso, which has dropped 9% against the dollar so far this year, the second-biggest decline in emerging markets. Amid an easing cycle that’s already reduced borrowing costs by nearly 5 percentage points, policymakers say the narrowing rate differentials with the Fed are largely to blame.

“Chile was the canary in the coal mine,” said Alejandro Cuadrado, a Latin America strategist at Banco Bilbao Vizcaya Argentaria SA, while also noting that some currencies like the Mexican and the Colombian peso have held up so far.

Analysts at the Institute of International Finance are revising their estimates for end-of-cycle rates in Latin America after Federal Reserve Chair Jerome Powell signaled this week that the Fed will wait longer than previously anticipated to cut borrowing costs.

“I still think there’s going to be room for central bankers in the region to keep easing monetary policy,” said Martin Castellano, its head for Latin America research. “But it will be at a slower pace, and depending on the country, it will be much slower or just slower.”

Bigger Noise

As of now, analysts still see room for inflation to slow across most of Latin America, though at a more gradual pace. Chile and Colombia have signaled easing cycles will continue at least for the next few months, while Peru delivered another — albeit timid — rate cut in April after having paused in March.

“If there’s a tightening of international financial conditions, that could make it a little bit more difficult for countries in the region to cut rates,” said Colombia central bank Governor Leonardo Villar. “Expectations can change in one direction or another in coming months.”

Policymakers are also still basking in investor praise after having beaten global titans including the Fed and the European Central Bank to reining in inflation and then starting borrowing cost reductions.

But as they face the ramifications from delays in rate cuts in the world’s largest economy, Latin American policymakers could inadvertently set the stage for a new wave of political tension.

“The noise will eventually be bigger when central bankers stop rate cuts, and will depend with what happens to growth,” said David Beker, Brazil chief economist at Bank of America Corp. “Now they face criticism, but they are still in cutting mode.

©2024 Bloomberg L.P.