Apr 26, 2024

Codelco Posts Fresh Output Slump, Underscoring Copper Struggles

, Bloomberg News

(Bloomberg) -- Top copper producer Codelco reported a decline in quarterly output due to lower quality ore at its aging Chilean mines — the latest sign of supply-side struggles that have helped send metal prices to two-year highs.

The state-owned company’s wholly-owned mines produced 295,000 metric tons, down 9.6% from the first three months of last year, Codelco reported Friday. The result was telegraphed earlier this month by Chairman Maximo Pacheco, who said the first quarter came in at 99% of an internal target.

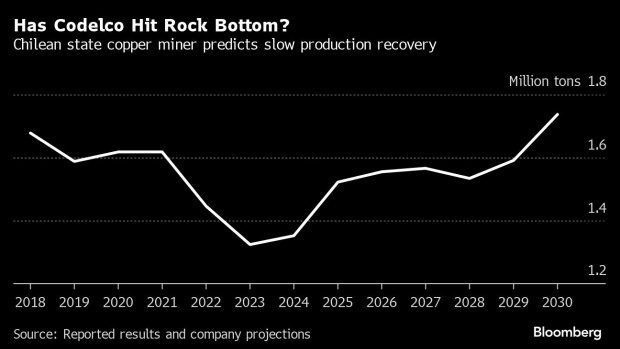

Pacheco and Chief Executive Officer Ruben Alvarado are gunning for a slight increase in 2024 after a yearslong slump due to setbacks at projects and mines. CEO Alvarado has shaken up management in a bid to finish late and over-budget projects that are key to tapping richer areas of its ore bodies. The company is getting some relief via lower operating costs, which drove up earnings last quarter. Its finances will also benefit from higher metal prices.

Read More: Why the World Needs More Copper — a Lot More Copper: QuickTake

Still, Codelco is enduring another setback as one of its mines continues a gradual ramp-up after a fatal accident in March at a time when its Chuquicamata underground operation is closed for maintenance and a rock collapse last year hinders output at the giant El Teniente mine. That may make for an uphill battle to achieve annual guidance of 1.33 million tons to 1.39 million tons.

Codelco’s plight is one of several supply disappointments fueling speculation that mines will struggle to meet a coming wave of demand from green industries. BHP Group’s bid for Anglo American Plc this week highlights that many miners would prefer to buy rivals than develop new projects.

--With assistance from Emma Sanchez.

(Adds costs and earnings in third paragraph.)

©2024 Bloomberg L.P.