Apr 17, 2024

China’s Solar Surge Is Making a Missing Power Data Problem Worse

, Bloomberg News

(Bloomberg) -- The boom in renewable energy installations in China is exacerbating a problem measuring power production data in the world’s second largest economy.

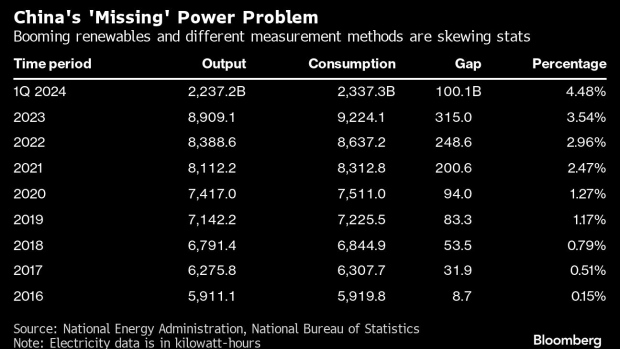

The gap between electricity consumption, as measured by the National Energy Administration, and power production calculated by the National Bureau of Statistics grew to 46.5 billion kilowatt-hours in March. That means 6.2% of power generation was missing from monthly output statistics that investors and policymakers use to assess important economic growth factors like gross domestic product.

The issue is that consumption data covers the entire country, but output data is only measured at facilities deemed large enough to matter to the economy. While that made sense in an era of massive coal-fired power plants located in or near urban centers, it’s been upended by the breakneck growth in wind and solar projects, many of which are housed in arrays that don’t meet the government’s threshold.

Then there’s the rapid uptake in rooftop solar, which covers houses and businesses and even farms across the country and isn’t counted.

And so the gap widens. In 2023, it amounted to 3.5% of total generation, up from less than 1% in 2018. Although electricity production accounts for a relatively small portion of the economy, the discrepancy is only likely to get bigger as China installs more clean energy. That could lead to underestimations in how much the economy is growing.

Generation from smaller plants does eventually get counted in annual statistical yearbooks, but those are published long after the monthly output data. In the meantime, analysts would be well served by being wary of monthly electricity production figures.

On the Wire

New sanctions on Iranian oil were included as part of a foreign aid package released by House Republicans Wednesday that is slated for a floor vote later this week.

BHP Group Ltd.’s iron ore production rose 3% in the year’s first three months, as the world’s biggest miner shrugged off heavy rainfall at its Western Australia projects along with dwindling demand in China.

President Biden’s call for higher tariffs on Chinese steel and aluminum — and his announcement of a formal probe into China’s shipbuilding industry — are likely to have limited near-term impact on these industries and on US-China relations, according to Bloomberg Economics.

The boss of Europe’s biggest copper company has accused his Chinese rivals of operating uneconomically and called on Western nations to take action to protect their own industries.

The Week’s Diary

Thursday, Thursday April 18:

- China’s 2nd batch of March trade data, including agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

- China March output data for base metals and oil products

- Oil conference in Chongqing hosted by OilChem and CPCA

- EARNINGS: Eve Energy

Friday, April 19:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Huayou Cobalt, Gotion

Saturday, April 20

- China’s 3rd batch of March trade data, including country breakdowns for energy and commodities

©2024 Bloomberg L.P.